Ministers from the Organization of Petroleum Exporting Countries, meeting in Vienna, blamed surging oil prices on the weak U.S. dollar and "mismanagement" of the U.S. economy. President Bush shot back, telling a renewable-energy conference in Washington that "it should be obvious to all that the demand [for oil] is outstripping supply." The U.S., he said, must change its habits. "We've got to get off oil," he said.

Mr. Bush urged OPEC this week to pump more oil. The cartel supplies just less than 40% of world demand.

OPEC ministers said they see a well-supplied market. OPEC President Chakib Khelil said the oil market is "moving into a new phase" of slower economic growth and ebbing demand.

The oil market is interesting right now. I don't think there s one factor that is pushing prices up, but instead a strong vortex of three events

-- Chine and India and their over 2 billion people have an increased standard of living. That means they want more energy (and food).

-- The dollar is dropping and has been for some time. That means the currency that oil is priced in is dropping which is a de facto increase in the price of oil.

-- There is a flight to the commodities area as an inflation hedge against the dropping dollar. It is also the only market that is rallying right now, so we're getting a number of speculators in the market.

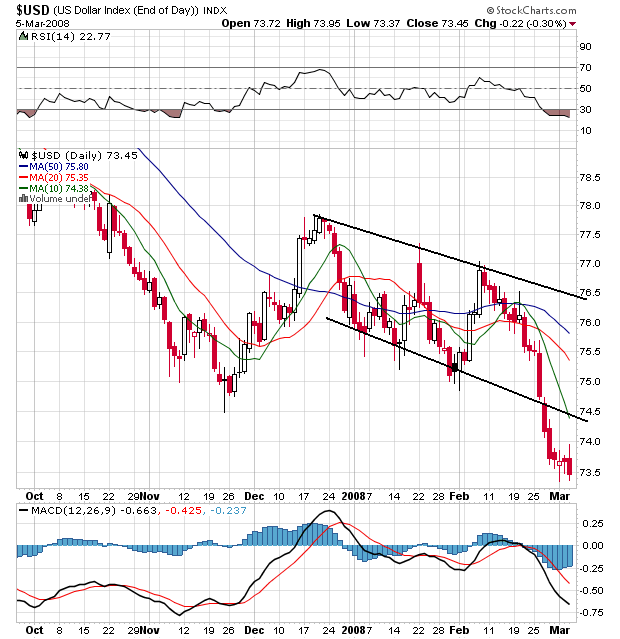

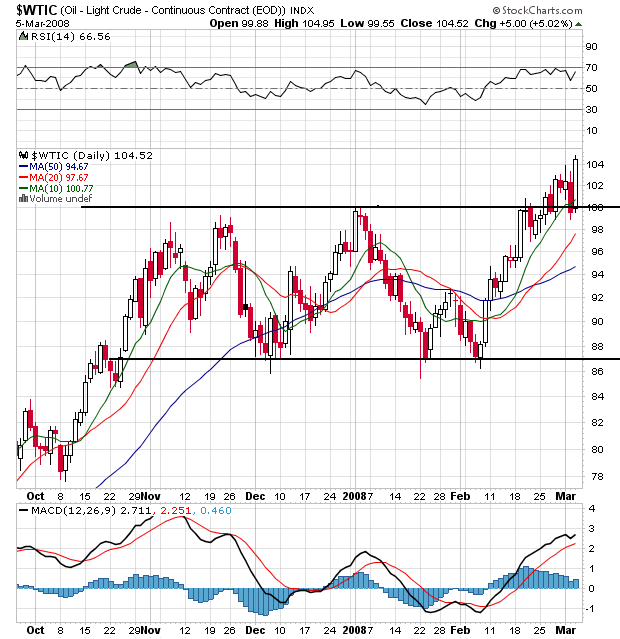

Let's see what the charts say about the oil/dollar price relationship.

Notice the following:

-- The dollar's chart is "down/bear market rally or consolidation/down

-- Oil's chart is up/consolidation/up.

Those charts look pretty "mirror imagey" to me. It's not an exact match, but it's pretty clear that oil and the dollar are clearly linked.