- by New Deal democrat

This is going to be a light week for data. We'll get new and existing home sales, and later in the week durable goods orders. So let's take a look at what houses and the biggest durables purchase made by consumers - namely, cars - are telling us about the economy.

UCLA Anderson School Prof. Edward Leamer made an excellent presentation[pdf] about the progression of business cycles at Jackson Hole in 2007. It is research I have relied on many times, including being able to see the beginning of the Great Recession ahead of time.

Here's the essence of his conclusion:

"The temporal ordering of the spending weakness is: residential investment, consumer durables, consumer nondurables and consumer services before the recession, and then, once the recession officially commences, business spending on the short-lived assets, equipment and software, and, last, business spending on the long-lived assets, offices and factories. The ordering of the recovery is exactly the same."Put simply, as an economic expansion ages, housing is the first sector to weaken, followed by cars. If they are strengthening rather than weakening, a recession is not near. And to be blunt, both sectors are indeed strengthening.

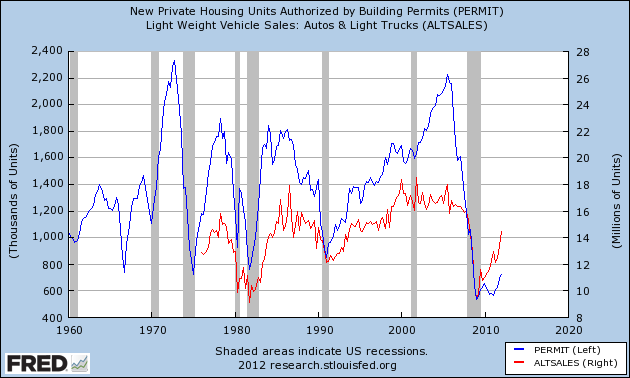

Let's look at this three ways. First here are the raw numbers of housing permits (left scale) and vehicle sales (right scale), measured quarterly to limit some of the noise. Both peaked well before any recession started, even in the case of the brief expansion in the middle of the 1980-81 "double dip":

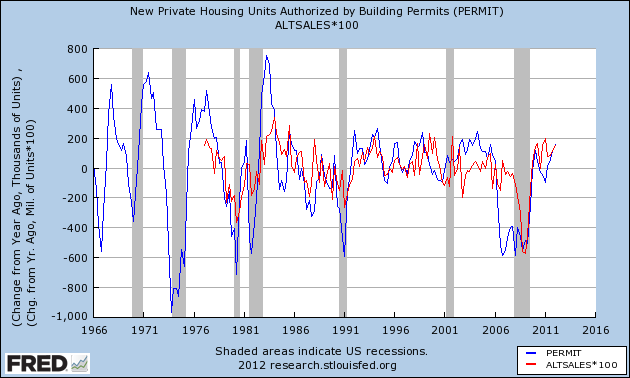

Now, here's the same data measured YoY on a quarterly basis. We get the same result - in this case, that the YoY decline fell below zero in all cases (with the exception of a 25,000 YoY increase in car sales YoY just before the 1981 half of the double-dip):

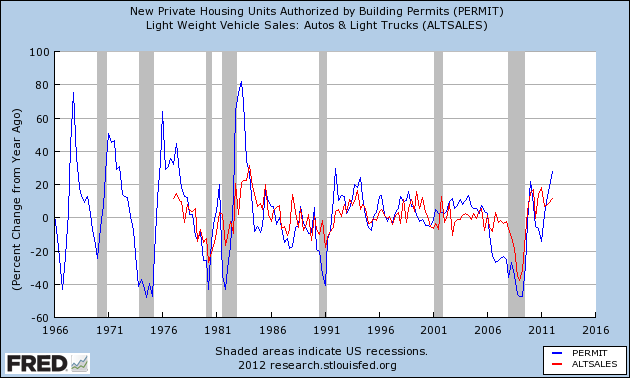

Finally, here's another look at quarterly data measured YoY, except this time measured by percentage instead of by number sold. Again, we get the same result:

Both home sales and car sales are strengthening, not weakening, through the first quarter. Even in the double dip, both house and car sales peaked two quarters before the onset of the second recession. In all other cases, at minimum, both have peaked at least 3 quarters in advance of a new recession. This tells us the economy should be strengthening, not weakening, in the months ahead.

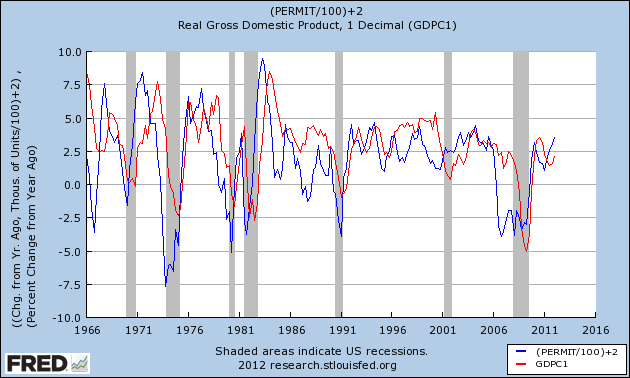

I've also mentioned that if for every 100,000 YoY improvement in housing permits (blue), generally speaking there is a 1% improvement in GDP several quarters later (red). The recent YoY improvement in GDP is following that script:

The continuing strength in housing and car sales suggests that improvement should continue, with YoY GDP growth rising to a level somewhere around 3%.