Now that we're probably in "bounce" territory, let's take a look at key levels.

I fully expect to see the market to technically rebound this week -- or at least for the next few days -- as buy-programs start to view current levels as under-valued. For the SPYs, pay attention to the 134.35 and 136 level. However, don't expect this to be anything more than a technical bounce; negative momentum is very strong right now, and volatility is up.

For the QQQs the important levels are 63.38 and 64.20 for now.

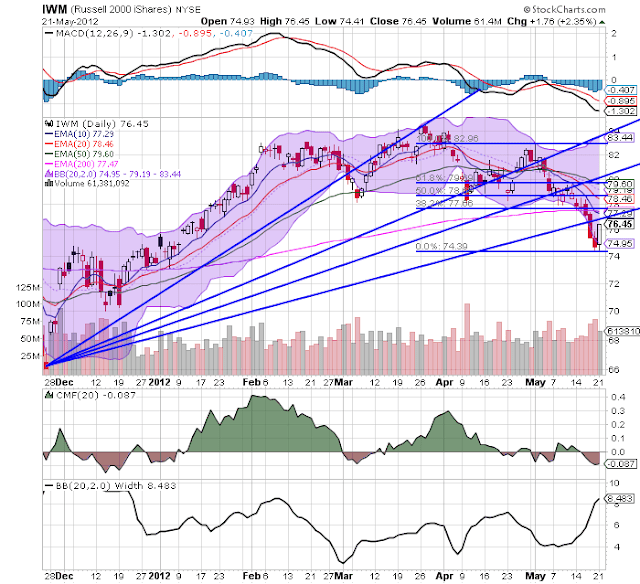

For the IWMs, it's 77.75 and 78.75

For all of the above averages, until prices move about the highest Fib level, we're still in a technical bounce area, nothing more.

The dollar -- which has broken out of a trading range -- is now retesting previous resistance levels at the 22.3-22.4 level. Expect to see prices find support in one of these areas over the week.

Over the last week, we've seen wheat spike sharply for two reasons. First, we're hearing rumblings from Russia that some type of drought is hitting the crop and, two, that diminished rain is going to hurt the US harvest. There's also been a fair amount of short covering going on. Right now prices are still contained in their six month trading range. But a move about the 7.00 level will be what to watch for.