The pace of economic activity appears to have slowed markedly, owing importantly to a decline in consumer expenditures. Business equipment spending and industrial production have weakened in recent months, and slowing economic activity in many foreign economies is damping the prospects for U.S. exports. Moreover, the intensification of financial market turmoil is likely to exert additional restraint on spending, partly by further reducing the ability of households and businesses to obtain credit.

I assume the Fed gets advance copies of of economic reports. Hence the inclusion of the following statement: "The pace of economic activity appears to have slowed markedly, owing importantly to a decline in consumer expenditures." The Fed obviously knew about the serious drop in consumer spending coming in the GDP report. Take a look at this post from yesterday or this one.

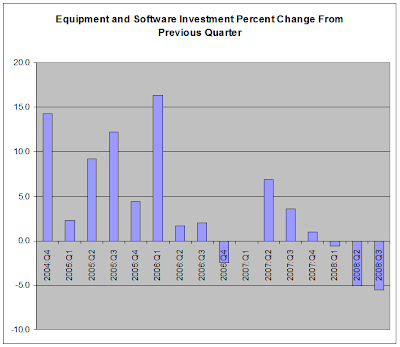

But there are obviously other problems: "Business equipment spending and industrial production have weakened in recent months."

Here are the relevant charts:

Business is pulling back on investment:

Leading to a drop in industrial production at the macro level:

While is also leading to a drop at the regional level:

Leading to lower capacity utilization:

In addition, "slowing economic activity in many foreign economies is damping the prospects for U.S. exports." Consider the following story from today's WSJ:

The crisis has yet to affect the job market in Europe's largest economy, Germany. The number of unemployed people there fell to 2.997 million from 3.081 million in September, translating into a fall in the jobless rate to 7.2% from 7.4%, data from Germany's labor office showed. German labor-office think tank IAB said it expects the first signs of adverse economic effects to feed into the work force in the second half of 2009. Some economists say those signs could emerge earlier.

"Unfortunately, this is probably just [Germany's] last hurrah. With the economy slipping into a serious recession, unemployment looks set to shoot up significantly next year," said Holger Schmieding, an economist at Bank of America in London.

Consumer gloom is dragging down retail sales in the region and is likely to feed through to weaker output. Spanish retail sales in September fell 5.6% on the year in calendar-adjusted terms after falling 5.9% in August and 6% in July, data from Spain's National Statistics Institute showed.

Manufacturers' selling-price expectations fell for a third consecutive month in October. The indicator that measures consumers' price expectations over the next 12 months edged up to plus 19 from plus 17, indicating more people expected prices to rise over the coming year. But October's figure was well below June's plus 31, indicating consumers think the inflation peak has passed.

And this:

Japanese Prime Minister Taro Aso unveiled a stimulus package with five trillion yen ($51.5 billion) in new government spending to buttress Japan's economy against the fallout from the global financial crisis.

.....

The stimulus package is the country's second in two months, and follows similar moves by governments world-wide. Japan, which economists say faces a steep recession, announced a set of stimulus steps in August with about 1.8 trillion yen in new spending to tackle high energy and material costs. The Bank of Japan is also considering a cut in Japan's already low interest rates for the first time in seven years.

Finally we have "the intensification of financial market turmoil is likely to exert additional restraint on spending, partly by further reducing the ability of households and businesses to obtain credit." The bottom line is the credit markets are still in need of help. Credit is tightening and consumers are slowing their spending in a big way.

Bottom line: The FOMC sees a very gloomy picture. And there's a damn good reason for the gloomy outlook.