Major carriers Northwest Airlines Corp. and ACE Aviation Holdings Inc.'s Air Canada on Tuesday joined the growing roster of airlines saying they plan to ground planes, reduce capacity and, in some cases, cut jobs this fall and winter. Discount carriers Virgin America Inc. and AirTran Airways, a unit of AirTran Holdings Inc., also weighed in with plans to reduce seats.

Also Tuesday, UAL Corp.'s United Airlines said its 2008 fuel bill, at current prices, will be $9.5 billion, a jump of more than $3.5 billion from last year. The carrier recently said it will cull 100 jets from its 460-plane fleet, trim capacity and cut its work force.

Even those seemingly prudent steps will lead to "significant" noncash charges in the second quarter related to impairment of assets, employee severance and the termination of contracts, United said. Those charges will swell what is expected to be a large loss for the Chicago-based airline.

As crude oil stubbornly clings to prices well above $130 a barrel, airlines of all stripes are finding many of their routes unprofitable, even as fares contime to climb incrementally. More bad news could surface Wednesday, when many airline executives are slated to speak at a Merrill Lynch global transportation conference in New York.

The charts for this industry are downright ugly: they way we're looking at the possibility of at least one bankruptcy and maybe more.

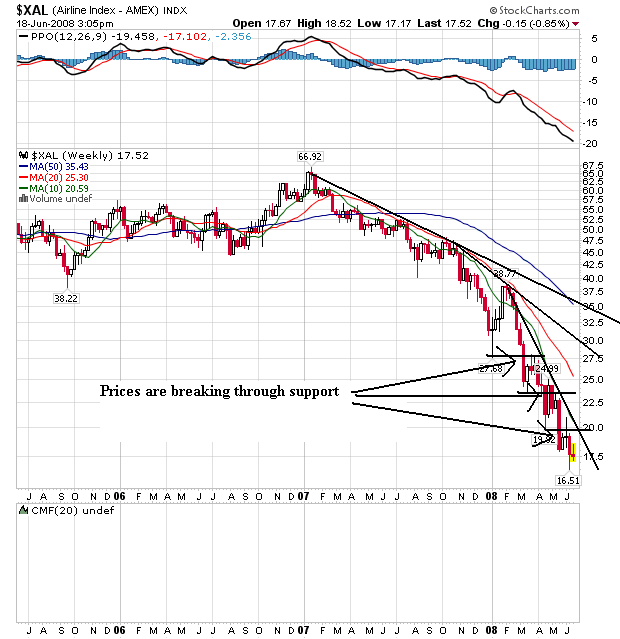

On the weekly chart, notice the following:

-- Prices have been dropping hard since last summer

-- All the SMAs are moving lower

-- The shorter SMAs are below the longer SMAs

-- Prices are below all the SMAs

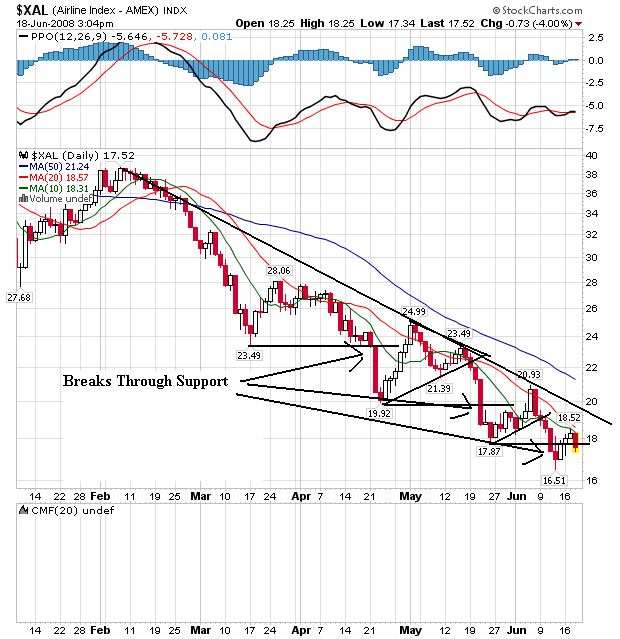

On the daily chart, notice the following:

-- Prices have been dropping hard since the beginning of the year

-- All the SMAs are moving lower

-- The shorter SMAs are below the longer SMAs

-- Prices are below all the SMAs

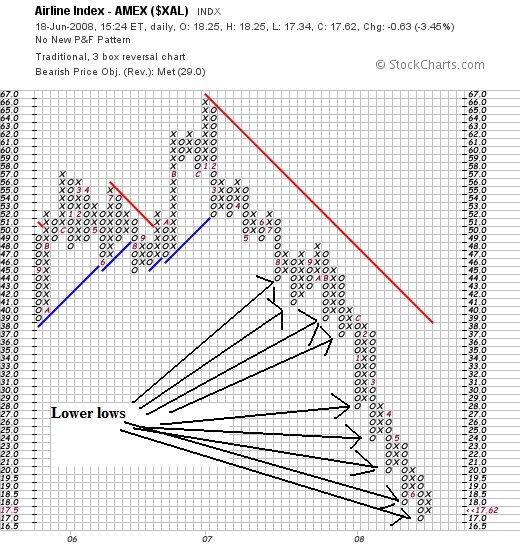

On the P&F chart, notice we've seen a series of lower lows.

Bottom line: this is an industry is deep trouble.