From today's WSJ:

Goldman Sachs economists estimate that as much as $3 trillion in mortgages could be underwater by the end of the year, leaving 30% of the country's outstanding mortgages in negative equity. Since there is roughly $1 trillion in subprime mortgages outstanding, that means a large amount of better-quality mortgages, such as prime and Alt-A -- a category between prime and subprime -- will be attached to negative equity.

This situation is already leading to people walking away:

Sgt. First Class Nicklaus Skaggs is among those looking to walk way. Mr. Skaggs bought his home in April 2005 shortly after returning to California from a one-year tour of duty in Baghdad.

The $455,000 three-bedroom home he and his wife purchased in Vacaville, about one hour northeast of San Francisco, is worth an estimated $285,000 today, well below the $453,000 he owes on his mortgage. The monthly mortgage payment, which jumped after its interest rate increased, is now $4,000, up from $2,980 when he bought the house.

Mr. Skaggs expects to be redeployed to Iraq again later this year. But he can't sell his home, since there are few buyers, and he can't refinance because lenders require a large down payment he doesn't have. Now, the 18-year Army veteran has decided to walk away from his mortgage. He hopes in a few years lenders see his decision as a unique situation created by the housing meltdown. "I don't think that house is going to recover in value any time soon," said the 40-year-old. "I'd just be throwing the money away."

.....

In the Phoenix area, where home prices were off 15% in the fourth-quarter when compared with a year ago, accountant Steven Ulrich says several of his clients have recently said they plan to walk away. One client's home is now worth $100,000 less than the mortgage and the other is $60,000 underwater.

"It surprised me," said Mr. Ulrich, who works at The Focus Group in Scottsdale. "I'd never had people doing that before, if they had to it was something they were forced into. But these people are choosing it as a strategy, and I think it's going to be happening a lot more."

First, this is entirely rational behavior. There is no point in paying more for something than it is worth.

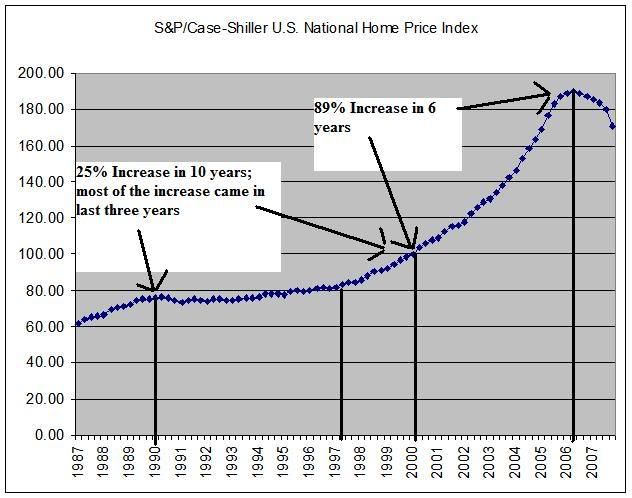

The financial sector is going to have problems for some time because of this. By some time I mean at least the next year and probably longer. Notice where home prices are on the Cash Shiller price index; prices are just starting to correct:

The bottom line is all the writedowns we've been hearing about are going to continue for the foreseeable future. The writedowns first started because the debt wasn't worth nearly as much as people thought it was. Now we have a second problem: lenders who actually hold the underwater mortgages will be forced to devalue them in order to reflect current market condition.

Now -- let's see how this will impact financial institutions. According to the FDIC, here are some highlights about where FDIC insured banks are currently:

For all of 2007, insured institutions earned $105.5 billion, a decline of $39.8 billion (27.4 percent) from 2006. This is the lowest annual net income for the industry since 2002 and is the first time since 1999-2000 that annual net income has declined. While much of the decline in industry earnings was concentrated among some of the largest institutions, evidence of broader weakness in earnings bespoke an operating environment that was less favorable than in previous years.

.....

Net charge-offs registered a sharp increase in the fourth quarter, rising to $16.2 billion, compared to $8.5 billion in the fourth quarter of 2006. The annualized net charge-off rate in the fourth quarter was 0.83 percent, the highest since the fourth quarter of 2002. Net charge-offs were up year-over-year in all major loan categories except loans to the farm sector (agricultural production loans and real estate loans secured by farmland).

.....

Despite the heightened level of charge-offs, the rising trend in noncurrent loans that began in mid-2006 continued to gain momentum in the fourth quarter. Total noncurrent loans -- loans 90 days or more past due or in nonaccrual status -- rose by $26.9 billion (32.5 percent) in the last three months of 2007. This is the largest percentage increase in a single quarter in the 24 years for which noncurrent loan data are available.

.....

Insured institutions’ loss reserves posted their largest increase in 20 years in the fourth quarter, but this growth did not keep pace with the growth in noncurrent loans.

Ladies and gentlemen, the quarterly banking profile indicates times are just starting to really hit the banks. But you ain't seen nothing yet.