On the short end of the maturity spectrum, demand remained solid as investors continued to turn away from risk and seek safety. As a result, the bond-equivalent yield on three-month T-bills fell as low as 3.91%, though it ended the session off that low at 3.984%.

Amid the dash for cash, the government's auction of $18 billion in two-year notes was nearly four times subscribed, the best level since 1988, according to Ian Lyngen, interest-rate strategist at RBS Greenwich Capital in Greenwich, Conn. Indirect bidders, domestic and foreign institutions, including foreign central banks, took 32.5% of the new two-year notes.

From IBD:

In fact, money market funds have seen record inflow as investors seek their safety. The Investment Company Institute said $43.67 billion went into money market funds the week ended Aug. 16. The previous week, it was $49.28 billion.

That's more than double the flow — $18.13 billion — for the week ended Aug. 1, before the subprime crisis picked up steam.

Money market funds are moving to shorter duration securities, despite the market's expectation of a decrease in the federal funds rate. Not long ago, the bias was toward a rate increase because of Federal Reserve chief Ben Bernanke's public stance that inflation was a concern.

.....

Jim McDonald, portfolio manager of taxable money market funds at T. Rowe Price, says that's odd. Ordinarily when the Fed plans to lower rates, money market funds move to longer duration securities to lock in higher yields.

But managers are so uncertain about further fallout from the subprime crisis that they are moving a chunk of their money into securities that mature the next day.

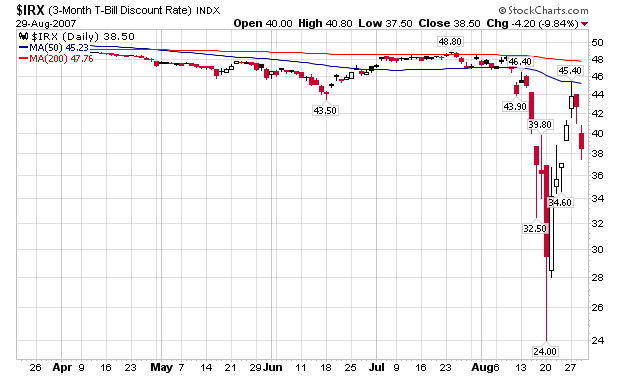

Here's a chart of the T-Bill yield.

And here's a graph of the current yield curve.

The flight to quality and the weight it is putting on the short-term part of the government yield curve is a primary reason why some some people are calling for a rate cut from the Fed. But there are some points these people are missing.

First -- this move shouldn't be overly surprising. During times of market turmoil, investors usually put money in safe and liquid short-term government bonds. This is often called a "flight to safety" because of the inherent nearly risk-free profile of government debt. In other words, investors are doing exactly what they should be doing during a period of market turmoil.

Secondly -- this isn't a bad thing. Investors are parking cash on the sidelines waiting for an opportunity. While these investments are safe, they don't yield that much after inflation. That means investors will eventually tire of low yields and look for a better return. There is no actual time line as to when this will happen. But if people continue to flock into the short-end of the curve, yields will continue to decrease, lowering return. And the lower the return goes, the more incentive investors have to look for higher yield somewhere else.

Third -- a steeper yield curve positively effects the Federal Reserve's outlook. A flat or inverted yield curve is usually a sign of an impending recession. A steep or normally inverted yield curve is the way the yield curve is supposed to look, with longer-dated bonds yielding more than shorter bonds. This is a yield curve that does not say recession. Remember that in this analysis, the reason for the yield curve's shape isn't important; all that matters is the actual shape.

In other words, right now investors are acting very rationally. More importantly, the market is acting as it should act.

The people calling for an interest rate cut want immediate gratification; they do not want the markets to work as they should. Instead, they are use to being bailed out of market turmoil by the Fed. This is to be expected given the Fed's actions in recent market problems. Here is a chart from the above cited WSJ article of the Fed's action to market problems. Note that over the last 15+ years, Greenspan has ridden to the rescue with an interest rate cut in the Fed Funds rate.

Right now the markets are doing exactly what they should be doing. When they unlock and move from government debt to higher yielding assets is unknown. But that will eventually happen. I hope the Fed let's that happen naturally.