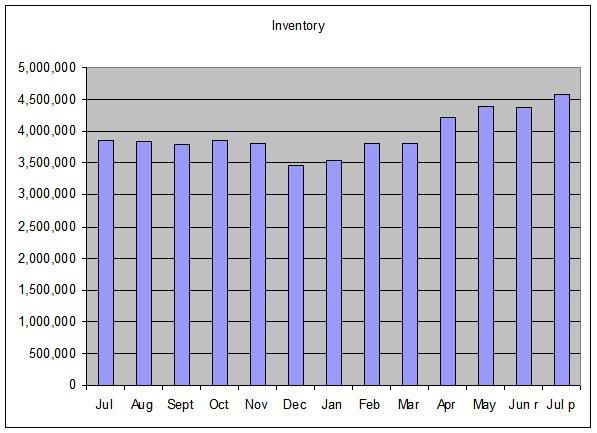

Inventories of homes for sale jumped 5.1% to 4.59 million, or about 9.6 months of supply at the current sales pace. A supply of about six months generally indicates a balanced market.

And the Blog Interest Rate Roundup noted:

It's also the highest level on record

So -- here's the graph.

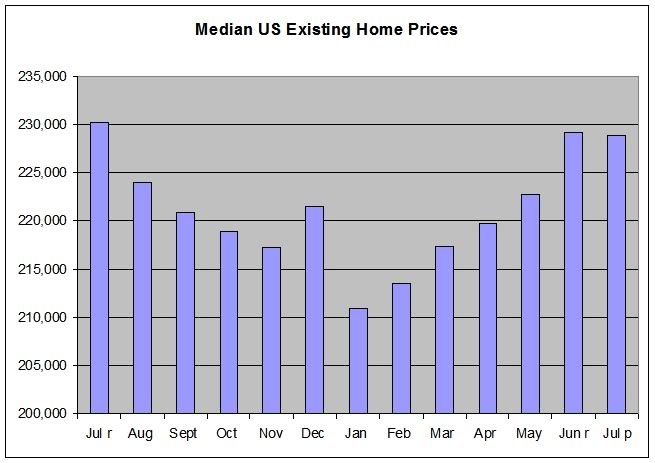

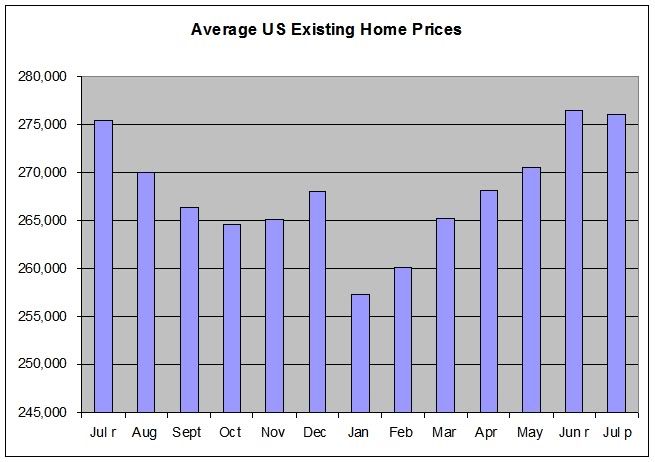

From the same report we have the following two graphs.

Median sales price:

Average sales price:

Now -- look at those three graphs and notice the following.

1.) Inventory has increased over the last 6 months and is now at the highest absolute level of record.

2.) Over the same period the average and median price increase as well.

Econ 101: excess supply (which we have in spades) + decreased supply (tightening mortgage standards) = lower prices.

We aren't anywhere near a bottom yet.