Construction

Over the last year, non-residential construction has risen in prominence in the construction sector, now accounting for more than half of all construction spending. In last month's GDP report we say a big bump in non-residential construction spending. However, that was before the credit crunch. The large bump may have been the last big push in non-residential spending as builders accessed tightening credit lines. So, keep an eye on this number for early signs of weakness in the employment picture. Here's a chart of total construction employment since January 2001. Notice it has leveled off but not declined.

Financial Services

Since the end of last year the financial services industry -- particularly the mortgage sector, has experienced a great deal of turmoil. According to the Implode-o-meter, 136 firms have "imploded" since late 2006. Yet the financial services employment number has continued to increase. Don't expect this trend to continue. Here's a chart of financial services employment since January 2001.

Retail

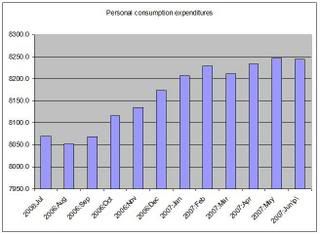

Inflation adjusted personal consumption expenditures have slowed over the last 5 months. Here's a chart of PCE's which are in chained 2000 dollars and adjusted to their seasonally adjusted annual rate.

Here is a chart of retail employment since January 2001. Note it has leveled off as well. Obviously, this number is strongly tied to consumer spending. More weakness in spending and we could see this number drop off.

Temporary Employment

From the WSJ:

Add another item to the economic worry list: Employers are shedding temporary workers.

Temporary employment, long a buffer that gives companies flexibility, has fallen each of the past six months, and in July was down nearly 2% from the start of the year, according to the Bureau of Labor Statistics. U.S. revenue at Manpower Inc., the world's second-largest staffing firm after Adecco Group, dropped almost 9% in the second quarter, as demand fell.

.....

Because the temp and overall job markets haven't tracked closely in recent months, the weakness in temp hiring could be a false indicator. "Nobody has ever seen this type of a pause in temp employment growth," Mr. Camden said. "This is just an unusual array of numbers...In general when you've had a long flat period, it's followed either by a sharp increase or a sharp decrease."

Here is a chart of temporary employment since January 2001.

My biggest concern is that weakness in all of these sectors hits all at once. For example, the mortgage market slowdown continues, hitting the financial services number. This in turn leads to a slowdown in construction spending, lowering construction employment. These two combined events lower consumer sentiment, lowering consumer spending. Given the current environment, the previous scenario isn't that far from possible.