From Bloomberg

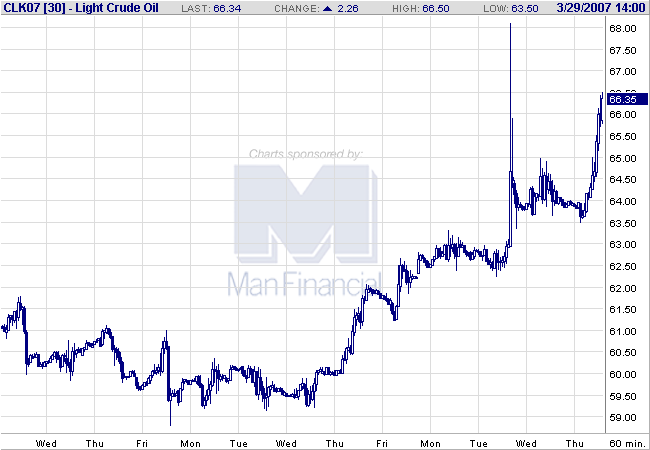

Crude oil rose above $66 a barrel in New York, approaching a six-month high, on concern that Iran's capture of 15 British sailors and marines increases the likelihood of a disruption of shipments from the Persian Gulf.

Iran, the world's fourth-biggest oil producer, won't release the only woman being held, a government official indicated today. Iran's foreign minister had said earlier she might be freed. Prearranged orders to buy futures at specific prices, known as stop orders, were triggered as prices rose.

``The Iranian tensions remain the main driver of this market,'' said Tom Bentz, an oil broker with BNP Paribas Inc. in New York. ``I wish there was something new to point to but there isn't. Once we got above $65 stops were triggered and the market went crazy.''

While the increase of tensions in the Middle East may be a reason for the increase, Boone Pickens argued fundamentals were driving oil prices:

The billionaire CEO of BP Capital said in an interview on "Squawk Box" that the current market is "very tight" because inventories have declined for seven straight weeks. He expects that will continue.

Thus, he rates the current market as being influenced by "90% fundamentals, but only 10% geopolitical." That could change, however, if the situation with Iran's seizure of 15 British sailors worsens and causes a blockage of the Straits of Hormuz, the waterway linking the Persian Gulf with the Indian Ocean.

Pickens does have a point. Here are the charts of gasoline and oil inventories, respectively. Gas inventories have dropped sharply for the last few weeks and oil inventories are lower now than at the same time last year.

While I think the tensions with Iran are more important than Pickens gives them credit for, the dwindling supplies are a classic reason for price increases as well. In short -- we need an increase in stockpiles to alleviate this situation somewhat.

However, with the summer driving season coming on, it may be too late.