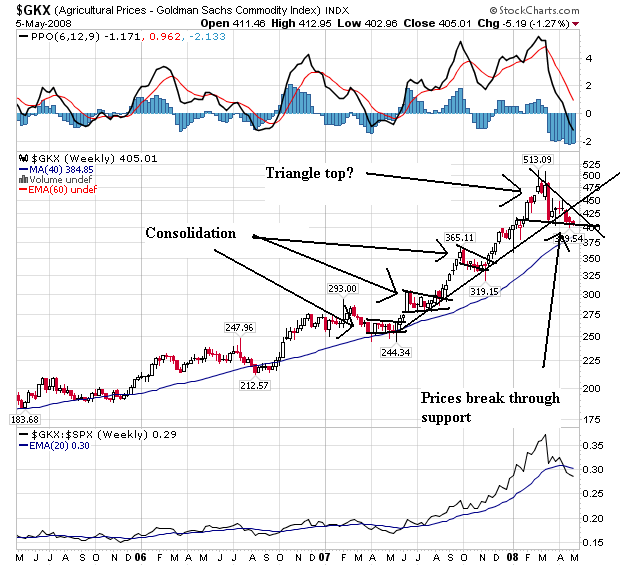

On the weekly agricultural prices chart, notice that prices have broken a year long upward sloping trend. Also note that prices are possibly forming a triangle top. Triangles are usually considered reversal patterns, but also note that prices have been forming consolidation patterns on the rally that has lasted the last year. That means this triangle could simply be another consolidation pattern on the way up.

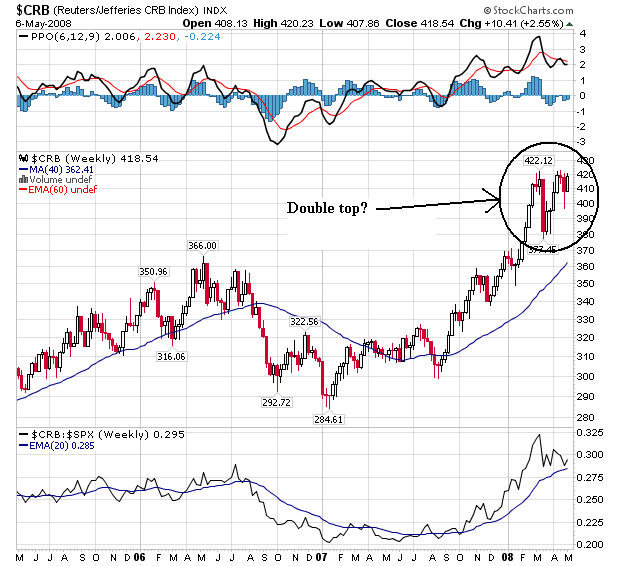

On the overall CRB index, notice we may be looking at an overall double top. Some of this will be determined by the dollar index which I will review on Friday.

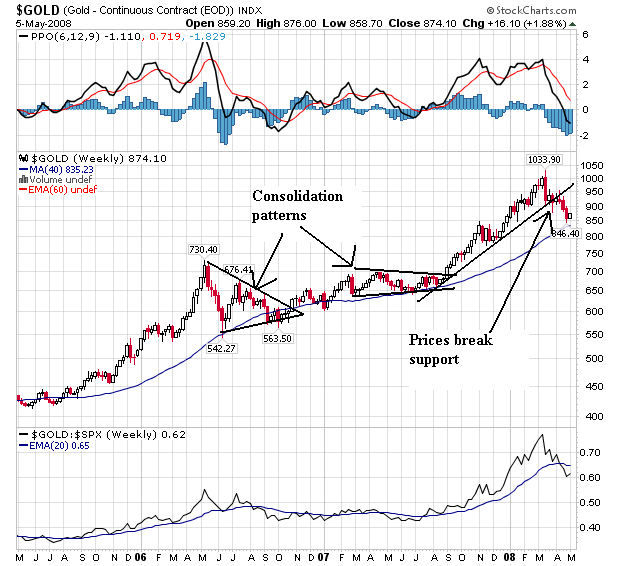

Gold has also broken a year-long uptrend.

Wheat has been under selling pressure because of the possibility of an increasing dollar. There is also news that farmers are increasing wheat crops:

Wheat fell below $8 a bushel for the first time in five months as investors speculated the U.S. will slow the pace of interest-rate cuts, boosting the dollar and reducing grain exports that surged as the currency weakened.

.....

Advance export sales of wheat in the marketing year that ends May 31 are 41 percent ahead of the year-ago period, U.S. Department of Agriculture data show. Actual shipments are up 46 percent, the USDA said in a report on April 24.

Still, analysts expect global production to rise as farmers plant more to capitalize on the higher prices. Farmers worldwide will harvest 645 million metric tons of the grain in the year that starts July 1, up 6.8 percent from the previous year, the International Grains Council said on April 24.

Producers in the U.S., the largest exporter of the grain, probably increased seeding in the marketing year that ends on May 31 by 5.6 percent to 63.8 million acres, the USDA said in a report last month.

``At this price level, growers are going to plant a lot of wheat,'' Holaday said.

Wheat is also dropping:

Consumer demand for rice may also slip, with some Asian consumers expected to adjust their diet to include more bread and less rice, Mr. Nelson said. Wheat, used to make bread flour, and rice are both major food grains.

Wheat is looking more affordable these days, as the price of the most-active CBOT July wheat contract has plunged to around $8 a bushel from $12 in March.

The world may see a record wheat crop this year after growers expanded plantings due to high prices. "Wheat is part of the diet in many of these countries," Mr. Nelson said. "To me, it seems like a part of the solution would be, as appropriate, that people could eat more bread."

On the daily chart of wheat, notice that prices are now near the lowest levels of the last 6 months.

On the weekly chart, notice that prices have broken through key support established in an almost year-long rally. That's a significant price break.

A rising dollar was having a negative impact on gold last Thursday:

"The return of dollar strength this morning has led to a swift reversal in direction with gold dropping back to $864, and given the pace of decline, suggests gold will remain at risk to further corrections in the coming sessions," said James Moore, an analyst at TheBullionDesk.com, in a research note.

Gold had finished Wednesday's regular trading session sharply lower, ending down $11.70 at $865.10. However, in electronic trading, gold rallied, boosted by the Federal Reserve's decision to cut the fed funds rate by 25 basis points to 2.0%.

"Despite the lack of a clear pause signal in yesterday's Fed announcement, the markets are treating May/June as the pivot point beyond which they can no longer reliably depend on ever cheaper dollars to fuel speculative binges in commodities," said Jon Nadler, senior analyst at Kitco Bullion Dealers.

On Thursday, the stronger dollar was also impacting the copper and wheat. IBD reported as much on Friday:

A resurgent dollar sent commodity markets reeling Thursday, as investors interpreted the latest economic data and monetary policy to mean interest rate cuts since September may be over.

Crude oil and gasoline fell as much as 3% each on the back of the dollar-related sell-off, as investors unloaded commodities denominated in the currency. Crude had hit record highs earlier this week, adjusting to the weak dollar and stronger rival currencies then.

Soybeans plunged 3% as well on Thursday, and grains like wheat and rice were under pressure as the dollar hit a five-week high vs. the euro.

In metals, gold sunk to a four-month low and copper plummeted 5% to a five-week low.

The Reuters-Jefferies CRB Index, which tracks 19 commodities futures, fell to a 3 1/2-week low.

And now because of food inflation concerns Congress is looking at the possibility of altering basic food policy in the US:

In Congress, some lawmakers are calling for changes in the nation's commitment to ethanol as the biofuel of choice to replace oil. "This is a classic case of the law of unintended consequences. Congress surely did not intend to raise food prices by incentivizing ethanol, but that's precisely what's happened," said Rep. Jeff Flake (R-Ariz.), who introduced legislation this week that would end federal support for ethanol.

After a huge run-up, the price of rice is retreating:

Chicago Board of Trade rice futures have likely seen a top for the year after global supply fears sparked a record-breaking rally, analysts said.

Nearby CBOT May rice has shed 17% since hitting its high of $24.6850 per hundredweight April 24. It settled Friday at $20.55. Most-active CBOT July rice has fallen more than 16% since reaching an all-time high of $25.07. The contract tumbled the daily, exchange-imposed limit for four consecutive days last week and closed Friday at $20.9450.

It seems as though all the bullish views about shrinking world supplies have been factored into the market, analysts said. Prices climbed recently as major producers like India and Vietnam curbed their export sales to protect domestic supplies, but there are now signs the tightness is easing, they said.

"I'm very much of the opinion that we've seen a top in the market," said Neauman Coleman, a principal at Neauman Coleman & Co., a brokerage and advisory firm in Brinkley, Ark. "From here, every time the market rallies, you're going to see an increase in folks who want to sell, particularly in the new crop months"

Above is a weekly chart of rice. Whenever prices move like this -- in a parabolic arc, the arc never lasts. Now the question becomes will prices maintain their downward trajectory or will they hover at high levels for the foreseeable future.

On the daily chart of rice notice the prices have broken through support established on the latest bull run.

However, with China still growing a high rates, it's possible that upward pressure on commodity prices won't slow down anytime soon:

In the first quarter, China's GDP expanded 10.6% vs. a year earlier, down from 11.4% in the last three months of 2007. China's inflation remains near decade highs, but slowing export gains make it less likely that Beijing will try to slam on the brakes, analysts say.

The Asian Development Bank forecasts that China's economy will grow 10% in 2008. The World Bank projects 9.4% growth. Much of the same is expected next year.

"China is the main source of increased demand for a lot of commodities, but the difference between 11.5% and 9.5% growth isn't that much," said David Wyss, Standard & Poor's chief economist.

More prosperous Chinese continue to buy bigger, gas-guzzling cars, driving up global oil demand. And China's rising energy and labor costs have been a factor in creeping U.S. inflation through the cost of imported goods.

"A slowdown in the Chinese economy would definitely take some pressure off of commodity prices, particularly crude oil, copper and steel," said Brian Bethune, chief U.S. economist at Global Insight.

The big news in commodities is some of the wind is leaving commodities' sales. We've seen some pretty important trend breaks in some big charts. This is very important from an inflation perspective. Commodities related inflation has been a big concern for some time.