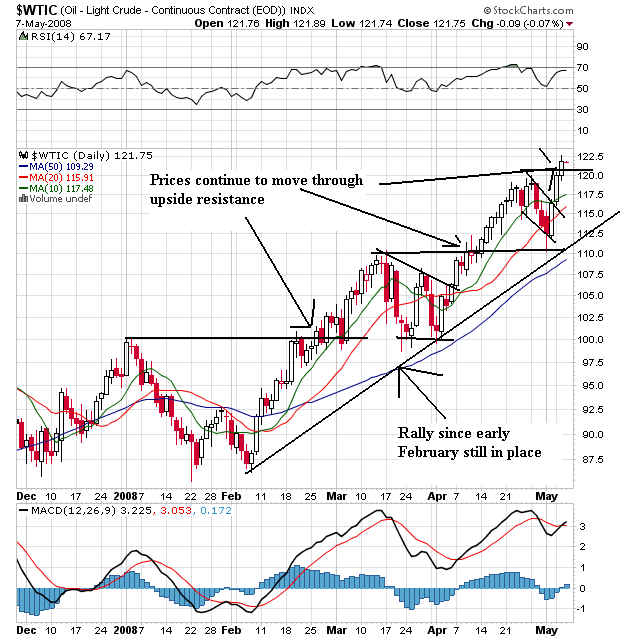

On the daily chart, notice the following:

-- The shorter SMAs are above the longer SMAs

-- Prices are above the SMAs

-- The trend that started in early February is still intact

-- Prices have continually moved through upside resistance

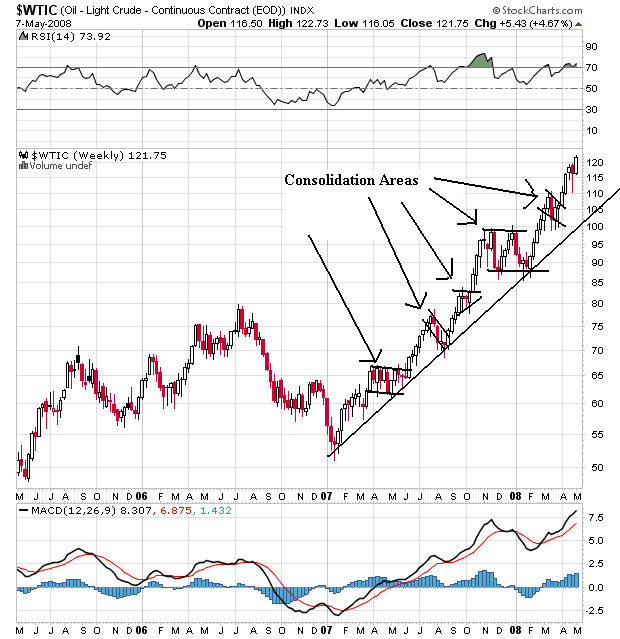

On the weekly chart, notice the following:

-- The uptrend that started in early 2007 is still intact

-- As prices have risen they have moved into 5 separate consolidation areas to absorb the gains.

After the Fed cut rates, oil dropped in response to a rising dollar:

Crude-oil futures fell for a third day Thursday as strength in the dollar reduced commodities' appeal as an investment alternative.

Natural gas futures also fell sharply after government data showed U.S. natural gas inventories rose more than expected last week.

Crude for June delivery dropped 94 cents, or 0.8%, to close at $112.52 a barrel on the New York Mercantile Exchange. It fell to an intraday low of $110 a barrel earlier. June natural gas futures fell 28.2 cents to end at $10.561 per million British thermal units.

Oil hit a new intra-day high on Monday:

Oil futures rose to an all-time high near $121 a barrel Tuesday in Asia, fueled by worries about threats to supply and a weakening of the U.S. dollar.

The surge in oil prices was also fueled by hopes that the U.S. economy will be spared a sharp downturn after the release of data Monday showing an unexpected expansion in the U.S. service sector in April, analysts said.

Light, sweet crude for June delivery rose to a record $120.93 a barrel in electronic trading on the New York Mercantile Exchange. The contract later retreated to $120.24 a barrel, up 27 cents from Monday's close. Crude futures settled on Monday at $119.97 a barrel, up $3.65 from Friday's close.

"The bulls are in control of the market," said Victor Shum, an energy analyst with Purvin & Gertz in Singapore. "The sentiment is that the oil pricing is likely going to stay quite strong, with a lot of volatility."

Monday's rise was based on the following geo-political hot spots:

Crude futures jumped $3.65, or 3.1%, to an all-time high $119.97 a barrel in New York as traders worried about developments in several key oil-producing countries: Diplomatic tensions between Iran and the West are rising again. Rebels have attacked Nigerian oil facilities in recent days. And Turkey recently conducted fresh strikes against the Kurdish minority in northern Iraq. Many analysts worry that long-simmering rivalry may see reprisals and continued violence this week.

While there are a lot of geo-political problems impacting oil, there is also the basic increase in demand:

Amid the occasional threats to crude supplies, global demand for oil continues to grow. While demand for oil and gasoline has been soft in the U.S., the Chinese and Indian economies are growing by double digits, boosting global demand for oil.

There is growing speculation that oil will continue on higher. Goldman was predicting $200/bbl oil in a recent report:

Crude oil may rise to between $150 and $200 a barrel within two years as growth in supply fails to keep pace with increased demand from developing nations, Goldman Sachs Group Inc. analysts led by Arjun N. Murti said in a report.

New York-based Murti first wrote of a ``super spike'' in March 2005, when he said oil prices could range between $50 and $105 a barrel through 2009. The price of crude traded in New York averaged $56.71 in 2005, $66.23 in 2006 and $72.36 in 2007. Oil rose to an intraday record of $122.49 today on speculation demand will rise during the peak U.S. summer driving season.

``The possibility of $150-$200 per barrel seems increasingly likely over the next six-24 months, though predicting the ultimate peak in oil prices as well as the remaining duration of the upcycle remains a major uncertainty,'' the Goldman analysts wrote in the report dated May 5.

There is also a growing realization that oil's upward climb may continue:

A growing number of oil-market watchers say voters riled by soaring fuel costs may face far worse this summer, as factors ranging from unrest in Nigeria to slumping production in Russia could shove benchmark oil prices over $150 a barrel.

.....

The world's diminished spare production capacity remains the strongest single catalyst for high prices, Mr. Yergin says. The world's safety cushion -- the amount of readily available oil that could be pumped in a moment of crisis -- is now around two million barrels a day, according to most estimates. That's just 2.3% of daily demand, and nearly all of the safety cushion is in one country, Saudi Arabia. Everyone else is pretty much pumping all they can, which makes the world vulnerable to political or other shocks.

And finally, gas prices are moving higher (again).

Once again, and for the sixth week in a row, the U.S. average retail price for regular gasoline moved higher, this time by one cent. As a result, the U.S. average price for regular gasoline set yet another all-time high of 361.3 cents per gallon. While the average price has gone up by 55.9 cents per gallon above the price a year ago, it has also shot up by nearly the same amount (exactly 56 cents) since December 31 of last year. On a regional basis, prices increased throughout the country with the exception of the Lower Atlantic portion of the East Coast where they went down a mere 0.6 cent. Elsewhere on the East Coast, prices increased by 2.5 cents per gallon in New England and 2.3 cents per gallon in the Central Atlantic while the average price for the entire East Coast region was 361 cents per gallon, a 0.9-cent increase. The average price in the Midwest was 357.9 cents per gallon, an increase of 1.1 cents. The increase in price for the Gulf Coast was smallest of any region, going up only two tenths of a cent to 350.7 cents per gallon. Despite an increase of 1.6 cents in the Rocky Mountain region, the price of 349.4 cents per gallon was the lowest for any region. The West Coast price went up by 1.4 cents to 380 cents per gallon, while the price in California increased by 1.1 cents to 390.3 cents per gallon.

Conclusion: there is no reason to think oil won't continue to move higher. The charts are incredibly bullish, demand is still strong, political tensions still exist (in a big way) and supply is tight.