So, let's get to the charts to see how we're going to start the week.

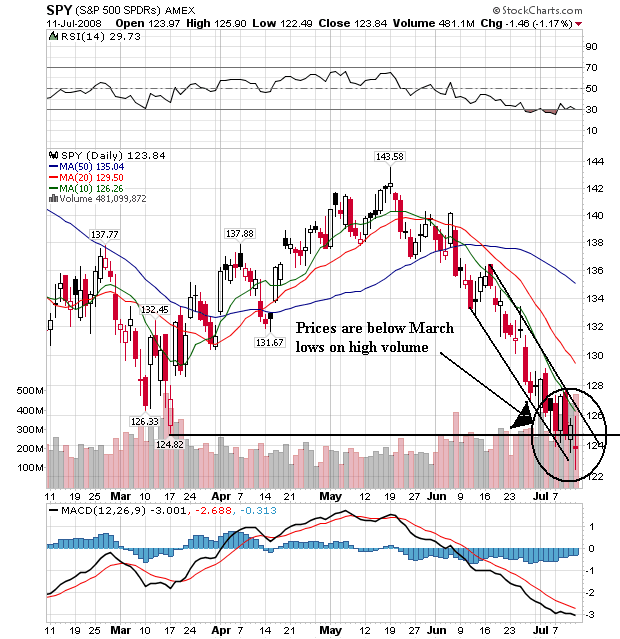

On the daily chart, notice that prices have fallen through March lows on high volume. Remember -- markets have memories. Previously attained price levels are psychologically important. When future prices violate previous prices, it usually means an important change in market psychology. Here, moving below this previously established low is a big deal.

Also note the following:

-- Prices are below all the SMAs including the 200

-- The shorter SMAs are below the longer SMAs

-- All the SMAs are headed lower

All these factors are bear market factors plain and simple

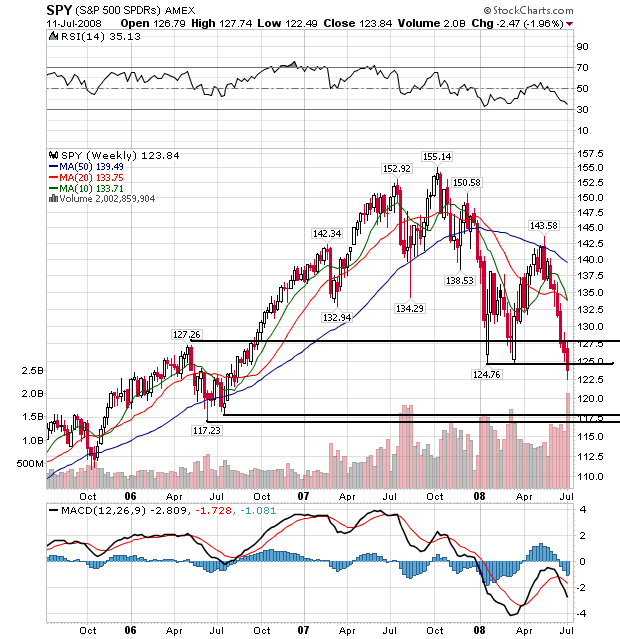

The weekly chart highlights two important points.

-- Prices have dipped below levels established in March

-- Prices dipped on high volume.

This is looking like the beginning of a second wave of a sell-off where prices move through technically important levels on high volume

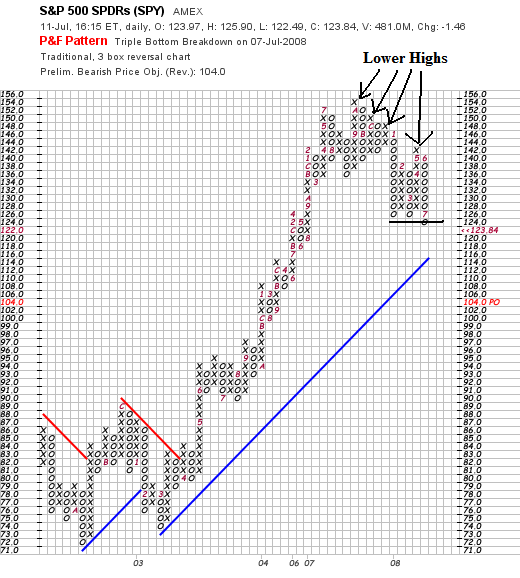

The P&F chart shows two important points:

-- The SPYs have made a series of lower highs, indicating declining momentum

-- The SPYs have broken through the recently established lows

All of the technical indicators tell us the market is not in a good shape.