I am puzzled why the remarkably similar housing bubbles that emerged in more than two dozen countries between 2001 and 2006 are not seen to have a common cause. The dramatic fall in real long term interest rates statistically explains, and is the most likely major cause of, real estate capitalization rates that declined and converged across the globe. By 2006, long term interest rates for all developed and major developing economies declined to single digits, I believe for the first time ever.

That's right -- it happened everywhere so I'm not at fault. What a self-justifying idiot. This is like an alcoholic blaming a bartender for his problem.

Let's review the basic facts.

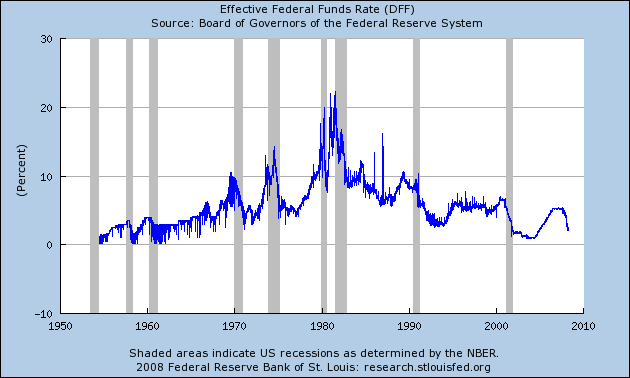

First, in the United States (where most US home buyers will get a loan), the Fed dropped interest rates to generational lows in the early 2000s. Here's a chart of the effective federal funds rate from the St. Louis Federal Reserve

At there rates, banks are basically paying people to take money. And take money they did. According to the Federal Reserve's Flow of Funds Report (PDF) total mortgage debt outstanding increased from $5.3 trillion in 2001 to $10.5 trillion in 2007. The number increased to $8.8 trillion in 2005.

For Greenspan -- who is a market based economist -- to now argue that the price of a good (here money) has no impact on its demand is the height of chutzpah.