European inflation accelerated to the fastest in almost 16 years in March, heightening the European Central Bank's quandary at a time when the economy is cooling and confidence is falling.

Consumer-price inflation in the euro area accelerated to 3.5 percent this month, the highest rate since June 1992, the European Union's statistics office in Luxembourg said today. That is faster than the 3.3 percent median forecast of 36 economists in a Bloomberg News survey. A separate report showed consumer and business confidence fell more than economists expected.

Rising food and energy prices are stoking inflation in the euro area, eroding consumers' purchasing power and pushing up costs at companies. ECB council member Erkki Liikanen said today that inflation expectations have ``hardened'' and the growth outlook has ``become more subdued,'' summing up the dilemma for the central bank, which is resisting cutting interest rates as inflation accelerates.

From Marketwatch:

Investors in interest rate-sensitive sectors such as automobile, financial services and real-estate firms are unlikely to breathe easy this week as India's inflation threatens to run out of control, dashing earlier hopes that the monetary policy could be eased some time this year to lift slowing economic growth.

In five quick weekly steps, the country's inflation shot up to a 15-month high of 6.68% in the week ended March 15, way above expectations of less than 6%, from 4.35% in the week ended Feb. 9. The more than two-percentage point inflation shock in such a short time has jolted policy makers just as it has economists, increasing chances of both fiscal and monetary action to prevent the situation from getting out of control.

And the government seems to be moving quickly. On Friday, trade minister Kamal Nath reportedly said the government was mulling an exports ban on some types of rice, while other government officials suggested a ban on edible oil exports, along with a reduction in import duties of other commodities.

It's important to remember the inflation picture is premised on spiking commodity prices. However, that picture may be changing.

The last rate cut by the Federal Reserve indicated that inflation was "elevated". In addition, the Fed cut 75 basis points rather than a full 100 basis points. This led some traders the the conclusion the Fed was near the end of its rate cuts. Whether this plays out is anyone's guess. But, the above chart indicates traders may be changing their thinking about the commodities market. Notice the following:

-- The index dropped about 7% the week of the Fed's rate cut.

-- Prices moved through the 10 and 20 day SMA

-- Both the 10 and 20 day SMA are now headed lower.

-- However, prices bounced off of the area where the 50 day SMA is currently located.

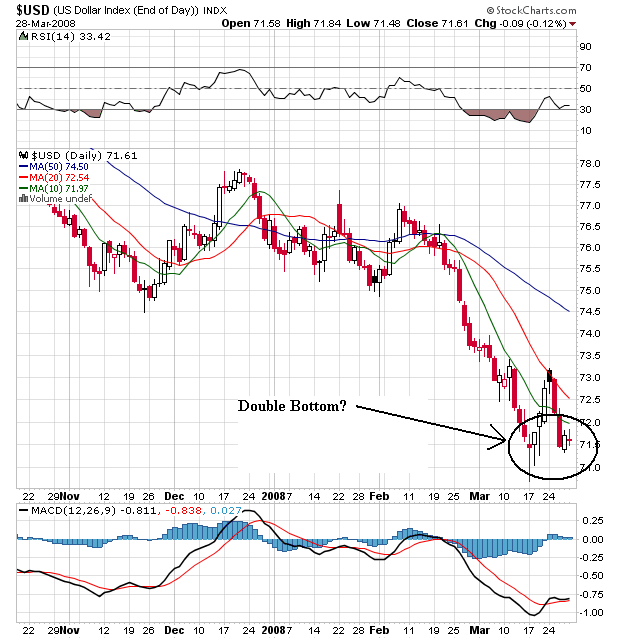

A lot depends on what happens with the dollar.

Notice the following.

-- There is still a bearish orientation to the chart.

-- All the SMAs are still headed lower

-- The shorter SMAs are below the longer SMAs

-- Prices are below the SMAs

-- However, prices may be forming a double bottom.

Short version -- the commodity price picture may be stabilizing for now.