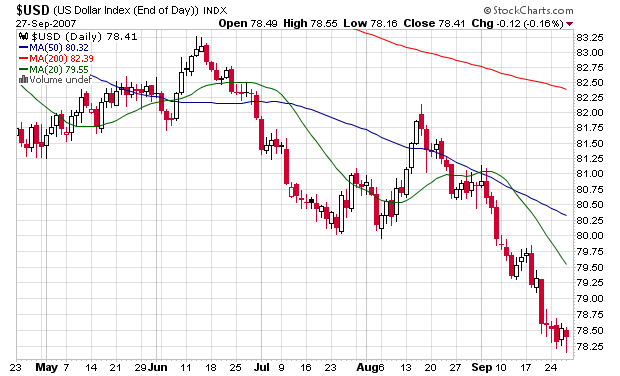

The dollar sank to an all-time low against a basket of major currencies as U.S. housing data continued to come in even weaker than economists' already-low expectations.

The New York Board of Trade's DXY dollar index, which began in 1973 and measures the dollar against six top rivals, fell to 78.16 in New York, beating its previous intraday low of 78.19, from 1992.

"The new low in the index was the result of negative dollar sentiment we've been seeing all week, starting with lower-than-expected housing data on Tuesday and magnified by weak new-home sales data" on Thursday, said David Powell, senior currency strategist at IDEAGlobal in New York.

Note on this above daily chart the dollar dropped right after the Fed cut the discount rate 50 basis points. Expect this trend to continue so long as the Fed is in easing mode.

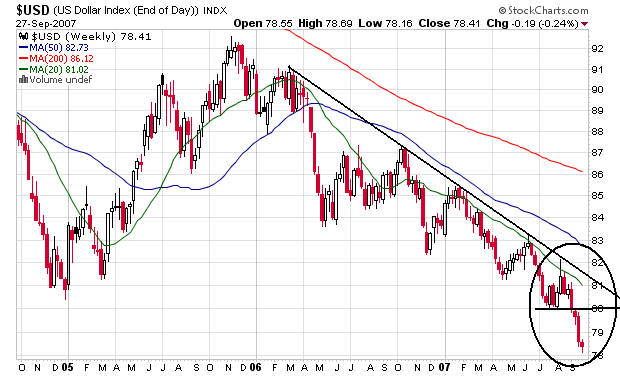

For those of you who want to cement a bearish chart in your memory, this is it. Notice the following.

1.) The trend is clearly downward. The sell-off for the last year has been constant and continued.

2.) All of the moving averages are trending lower. I think of the moving averages as the general price movement for the last x period. For example, a 10 day moving average is the two week trend. The 20 day moving averages is the weekly trend. Notice here all of the moving averages -- short, medium and long-term -- are moving lower.

3.) The shorter moving averages are below the longer moving averages. The means the short-term trend is pulling the longer term trends lower.

4.) Prices are below the moving averages. This is pulling all of the moving averages lower as well.

5.) Recent, post rate cut price action is circled on the chart.

The bottom line is this chart says "sell-me". Period.