From the minutes of the latest Central Bank Meeting:

The estimate of GDP growth in the second quarter had been revised up a little to 0.7% in the second release. The initial estimates of the expenditure breakdown had suggested that growth had been fairly broadly based, with investment and export growth both a little stronger than the Committee had anticipated. Such initial estimates for the expenditure components were, however, highly uncertain. There were other reasons for caution. For instance, the strength of exports was concentrated in a couple of subsectors and appeared erratically strong by comparison with the growth of world trade volumes during Q2; and the large positive contribution to growth from stockbuilding would probably prove transient, especially if it were simply a bounceback from the temporary de-stocking observed in the first quarter.

Nevertheless, that modestly promising data release had been augmented by the continuing strengthening of the indicators of consumer spending in 2013 Q3 and further strong business surveys in August. The Markit/CIPS services activity index was broadly unchanged in August, after having increased sharply in July, and the manufacturing and construction indices had strengthened further. Consequently, the composite PMI was at its highest level since 1997. The CBI service sector survey had also strengthened in August. Overall, Bank staff estimated that the initial estimate of output growth in the third quarter would be around 0.7%, compared with the 0.5% expected at the time of the August Inflation Report. Moreover, the early indicators for activity in Q4 tentatively suggested further strengthening towards the end of the year. Overall, these data provided further evidence in support of the pickup in growth assumed at the time of the August Inflation Report and, if anything, posed an upside risk to that path.

Since the spring, and after several years of stasis, activity in the housing market had been picking up and, on the basis of recent indicators, gaining momentum. Although still well below pre-crisis norms, monthly mortgage approvals had increased by almost a third over the past year. And, according to the average of the main lenders’ indices, nominal house prices in July stood around 4% higher than a year earlier and so had begun rising in real terms for the first time since mid-2010. In a confidential preview of the survey, the RICS current house price balance had risen to a level last seen at the end of 2009. There had also been signs of an easing in conditions in the commercial property market.

Let's look at the major macro-level data to elaborate on the above.

GDP annual growth rate appeared to be stalling 1-3 quarters ago, printing at the 0$ and .1% level. But the latest reading has the annual growth rate at 1.5%.

The inflation rate has been consistently printing in the 2.5%-2.8% range for the last year.

Like the US, the UK has had a stubbornly high unemployment rate, coming in at 7.7%+ for the last year.

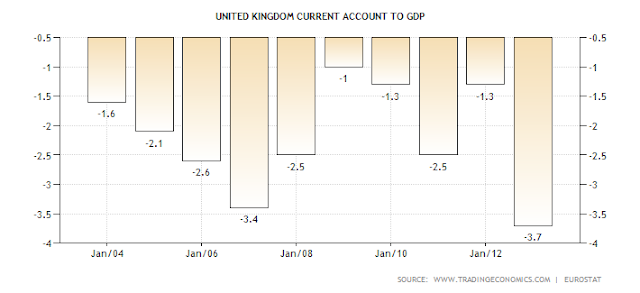

While there current account gap is negative, the UK prints their own currency, making this a problem the country can deal with.

The government budget deficit has been decreasing as well.

Let's see how this is translating in the relevant market action.

The pound has been rallying since the beginning of July, finally rising about the 200 day EMA in early September. The shorter EMAs are now above the 200 day EMA as well.

The UK ETF broke through resistance in the lower 19 area in early September as well. Prices have fallen back a bit since then, but that's to be expected after a strong move higher.