. - by New Deal democrat

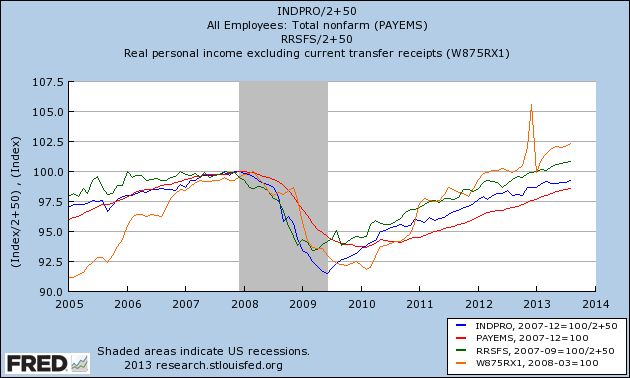

This morning's release of personal income and spending completes the monthly reports for the 4 big coincident indicators for the economy, shown in the graph below, in which the pre-great recession peaks are normed to 100: Industrial production (blue), payrolls (red), real retail sales (green), and real personal income ex transfer payments (orange):

Personal income rose 0.4% in August, and the PCE deflator only rose 0.1%, so real personal income rose 0.3%. July's number was also revised higher by 0.1%.

Real GDP completely recovered to its pre-recession highs over a year ago. As shown in the graph above, both real income and real retail sales are also above their pre-recession peaks. Payrolls, which contracted by over 8 million jobs, are about 1.6 million from their pre-recession peak. At 160,000 jobs a month, it will take us 10 more months to exceed that peak. If the +345,000 preliminary upward revision by the BLS for the last year sticks, it will take 8 more months. Finally, industrial production has made up all but 1.7% of its 17% loss during the recession. Depending on how you measure its trend from the June 2009 bottom, it should exceed its pre-recession peak in about 5 to 8 months.

Since the short leading indicators for the economy suggest that there will be a little more strength in the next 6 months or so, it looks very much like the economy will have fully recovered by sometime next spring. Should that come to pass, then at that point we'll no longer be talking about economic recovery, but simply economic expansion.

Where there's been not so much of a recovery, of course, is when you measure per capita, and in particular by population-adjusted job creation, and in median wages. The economy is actually doing pretty good, the average American in it, not necessarily so much.