While the election results from tomorrow will wind up having a great impact on the economy in the next two years (so please make sure you vote!), economic news this week will be dominated by the jobs report on Friday.

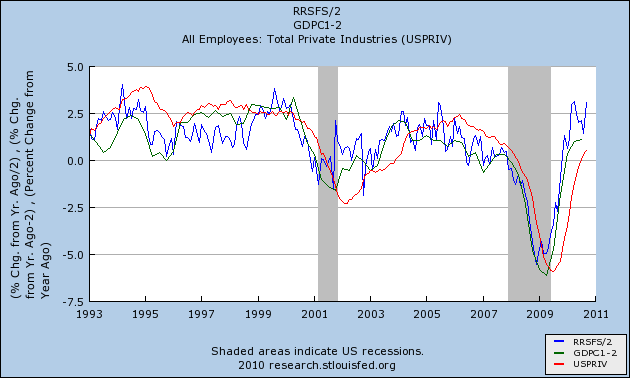

The advance GDP report allows me to update my YoY graph of real retail sales (blue), real GDP (green), and nonfarm payrolls (red):

Real GDP is up about 3.1%. Since you don't get job creation unless GDP is up over 2%, in the graph above 2% is subtracted from YoY GDP growth. GDP leads jobs, and real retail sales leads both. For the last 6 months, real retail sales have been up an average of about 4%. That should eventually result in 2% job growth, or 2,5000,000 jobs. Even if stimulus money has created jobs in Asia in response to retail spending here, nonetheless real GDP growth suggests eventual job growth of about 1,500,000 YoY. The questions are, how fast and how soon?

The two most important sectors to watch on Friday are the two for which stimulus lapsed: construction and state/local government. As I have pointed out a number of times, this "reset the clock" back one year in both areas. Normally, construction jobs would have been growing for almost a year, and state/local layoffs, which depend on tax returns and thus lag about a year, would be tailing off. Not so this time.

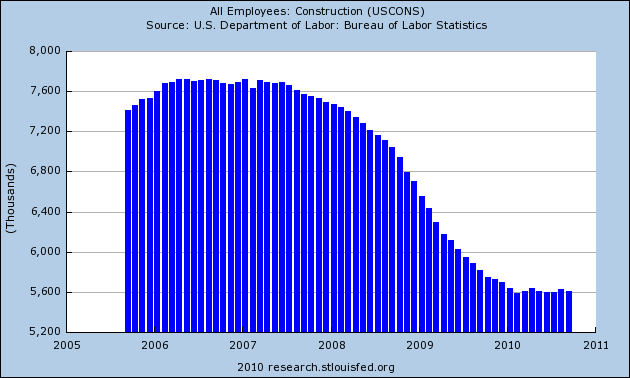

Here is a graph showing construction employment for the last 5 years:

This leveled off at the beginning of this year. On Friday a positive number would be as good as can be hoped for, and at very least a loss of less than 20,000, which keeps this series in its range for the year, would at least mean that the bottoming out process is intact.

While I can't show you a nice graph of government jobs, because of the Census distortion, it is clear that we are going to continue to lose jobs here. Last month we lost 47,000. Some of that was probably seasonal due to the school year vs. education layoffs. We probably won't see a positive number here, but a substantial decline in jobs lost compared with last month would be a start.

P.S.: Last week I highlighted TrimTabs' use of daily tax withholding receipts to estimate job gains or losses. So far, they have not made any public statements about October's jobs number.