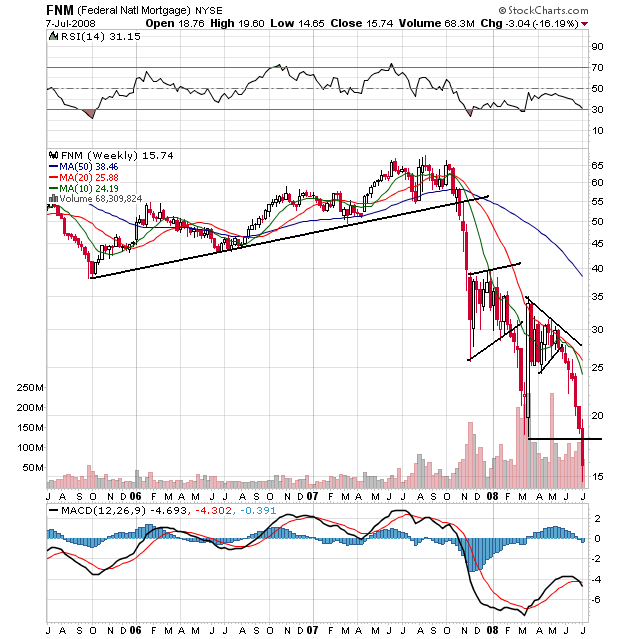

A research report from Lehman Bros. saying that a new accounting rule might require companies to account for securitized assets on their balance sheets sent shares of Fannie Mae and Freddie Mac, the largest providers of funding for U.S. home mortgages, to their lowest levels since 1992 on concern that they would need to raise more capital amid larger-than-expected losses.

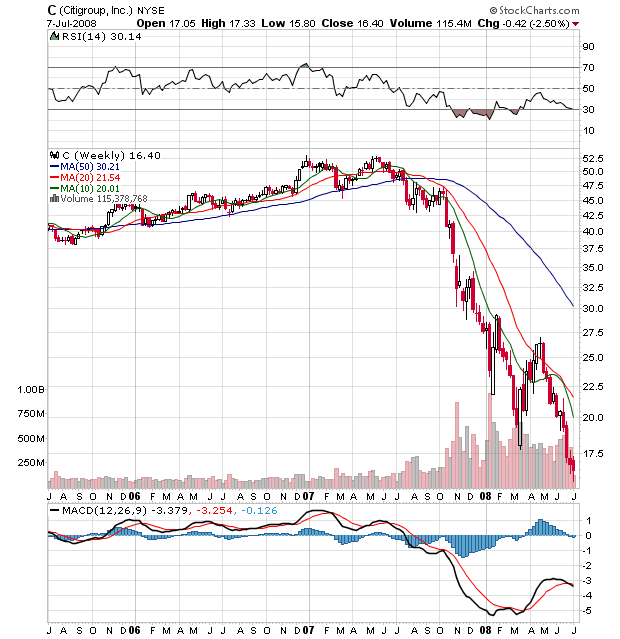

Remember about a year ago when a research analyst wrote a report about Citigroup that said the company would cut its dividend and take massive writedowns? That analyst was pilloried for that report. Since that report Citigroup has dropped about 60% because they have written down a ton of debt and had to raise additional capital. Here's the chart:

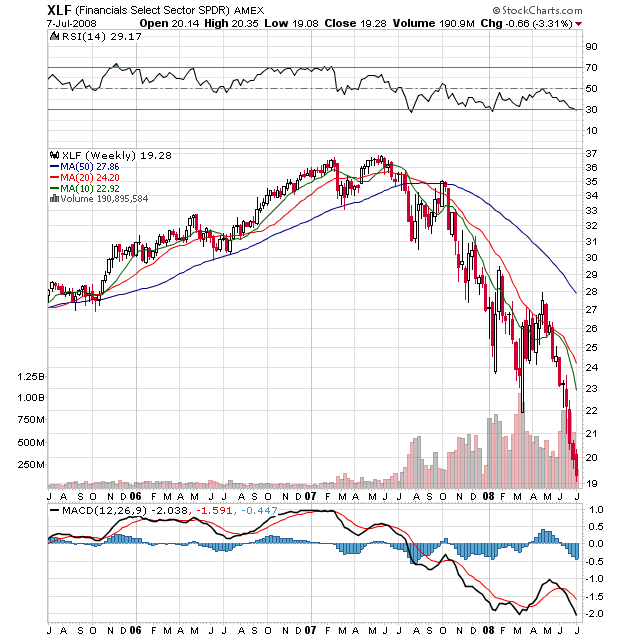

I raise the Citigroup comparison because they are hardly alone. In fact the entire financial industry is under tremendous selling pressure. Take a look at the Financial ETF:

Prices have been in a confirmed downtrend since mid-2007. They have continually made lower lows and lower highs. All the SMAs are moving lower, prices are below all the SMAs and the shorter SMAs are below the longer SMAs. This is a bearish chart if ever there was one.

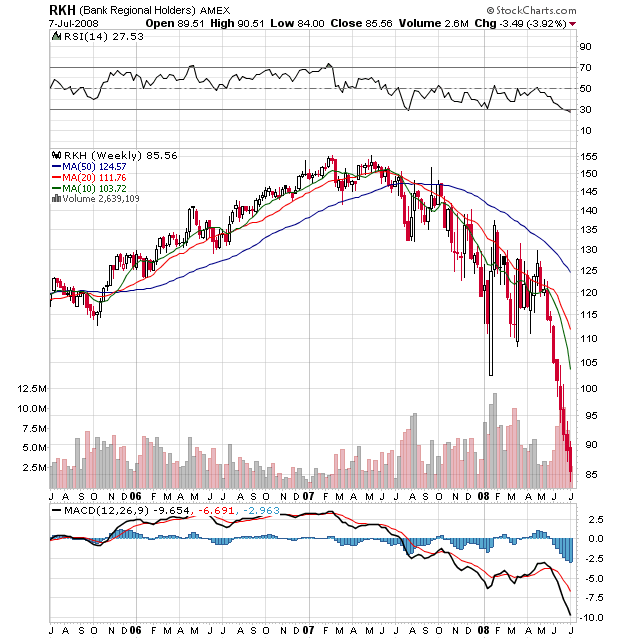

The regional banks are no different:

Prices have been in a confirmed downtrend since mid-2007. They have continually made lower lows and lower highs. All the SMAs are moving lower, prices are below all the SMAs and the shorter SMAs are below the longer SMAs. This is a bearish chart if ever there was one.

And now we have two of the most important financial companies in the market with big problems on their hands.

Fannie Mae and Freddie Mac triggered a surge in the cost of protecting company debt from default to the highest in 14 weeks on concern the two largest U.S. mortgage finance companies may need to raise $75 billion.

How important are Freddie and Fannie?

Fannie and Freddie are government-chartered companies that provide the bulk of funding for U.S. home mortgages. They own or guarantee about $5.2 trillion of home mortgages, or roughly half of all home loans outstanding.

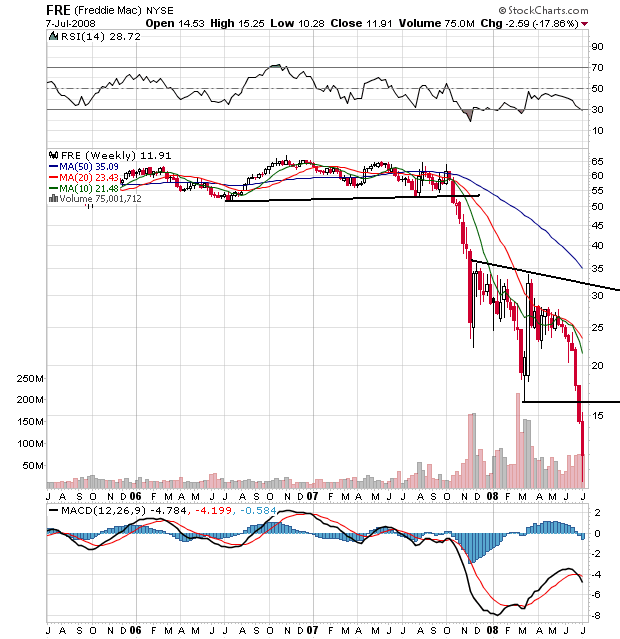

That's how important. Half of the mortgage market depends on these two companies being healthy. And their stock price indicates they are not:

Freddie stock has fallen off a cliff, moving from the mid-50s to $11.91. That's a huge drop. And Fannie isn't doing much better:

Fannie has also moved from the mid-50s to 15.75 or so.

And yet -- despite all of these obvious problems -- talking heads on TV are still saying the financial sector is cheap! It's time to buy! Anyone who is taking this advice deserves to lose every single dollar they invest. These guys are idiots of the highest order.

The bottom line is we are nowhere near an end to the problems in the financial sector.