U.S. drivers are doing something they haven’t done for nearly two decades — consume less gasoline.

Gas consumption so far this year is down about 0.2 percent compared to last year, according to the Energy Information Administration. The federal agency is predicting that gasoline demand will be down 0.4 percent this summer and 0.3 percent for the year.

That may not sound like much, but it would be the first time since 1991 that there’s been a decline in annual gas consumption. And it would be only the eighth year since 1951 in which demand for gasoline has declined.

The federal agency noted that the decline was occurring in part because of a slowing economy. But it also said that higher gas prices were having an effect on demand.

“Sustained higher gasoline prices are beginning to show up in lower gasoline consumption,” said Tancred Lidderdale, an analyst for the Energy Information Administration.

Both gasoline and diesel prices are now at record levels.

Here are two charts from This Week in Petroleum to show where retail prices are:

Notice that instead of falling in the winter, both gas and diesel prices remained at high levels. I think this is an important contributing factor to the slowdown that occurred in the fourth quarter.

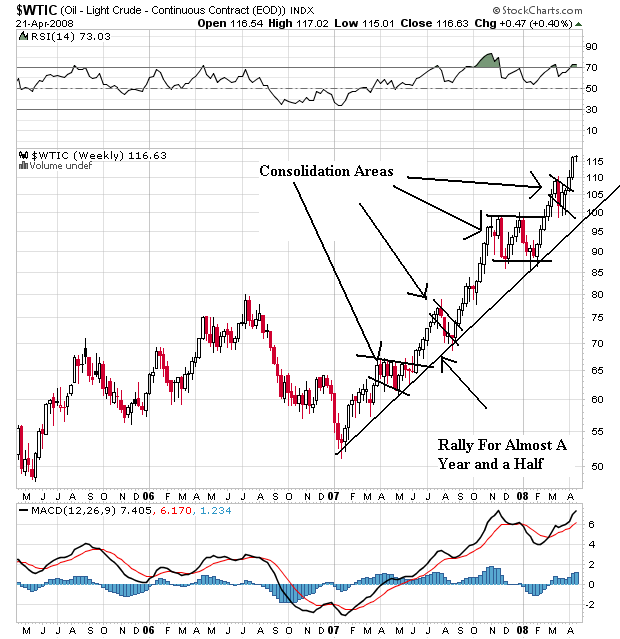

Also consider the following graph of oil prices:

Oil has been in a rally for almost a year and a half. Notice the market has continually advanced through previous resistance levels, consolidated gains and then moved higher.

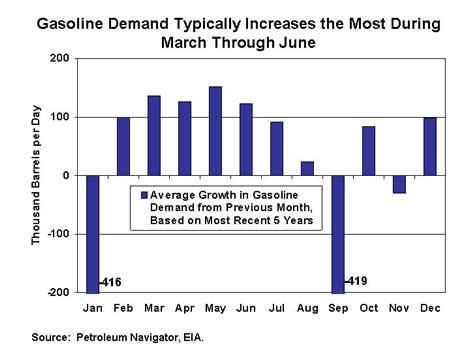

However, we're moving into the summer driving season when demand typically increases:

Since last fall, the average U.S. retail price for regular gasoline has been close to or above $3 per gallon in large part due to high crude oil prices. High crude oil prices are expected to remain an important reason why retail gasoline prices are projected to stay above $3 per gallon for some time to come. As the chart below indicates, we are now in the “time of the season” when gasoline demand begins to increase. As seasonal demand increases, prices tend to rise as well, all else equal. Even though U.S. gasoline demand has been lower than year-ago levels so far this year, EIA still expects that rising gasoline demand over the next few months will drive retail prices higher. So, while gasoline prices have risen above $3 per gallon mostly due to high crude oil prices, increasing gasoline demand will likely take retail gasoline prices to $3.50 per gallon and above, even if year-over-year gasoline demand is negative. The simple fact that more and more gasoline will be used over the next few months will probably be enough to cause retail gasoline prices to increase, even if crude oil prices begin declining, as EIA is currently projecting. Additionally, the cost of making “summer-grade” gasoline (“summer-grade” gasoline produces less smog) is significantly more than making “winter-grade” gasoline, helping to raise retail prices even further during the summer months, all else equal.

Finally, I have two words: India and China. Simply put, US demand is no longer the only driving force of the oil market. There are now over 2 billion more people who've seen their standard of living increase.