The company raised its provisions for loan losses 10-fold to $560 million on expected losses on mortgages, home equity credit lines and residential construction, it said.

Let's combine that with some other happy news in the financial sector:

Federal banking regulators will hire 140 new employees in an effort to reassure the public they are well-positioned to deal with a possible increase in bank failures over the next year, the Federal Deposit Insurance Corp. said Tuesday.

Also consider the following graphs from the latest Quarterly Banking Profile from the FDIC:

Non-current loans and charge-offs are increasing

As are loss provisions for deal with the increasing charge-offs

Non-current loans and charge-offs are now at levels last seen during the last recession.

Residential mortgage loans losses have been increasing for almost two years

And non-current rates on commercial and industrial loans are are their highest rates in 11 years.

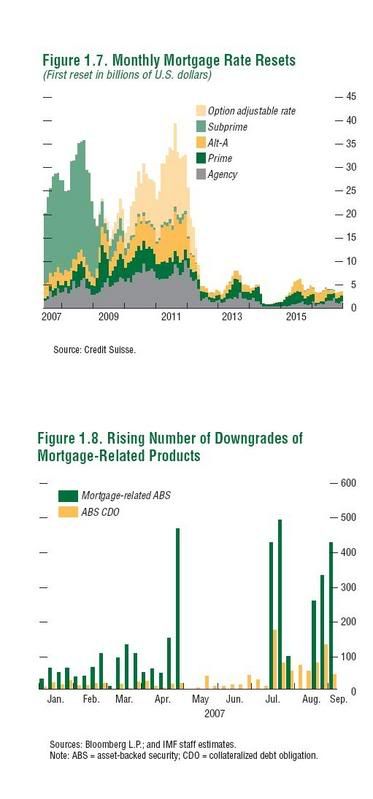

These charts tell me problems in the financial sector are just getting started. And just in case you think everything is all hunky-dory, consider we get to go through another two years of resets starting in about a year and a half