The dollar plummeted to below ¥100 for the first time since 1995 and hit record lows versus the euro and the Swiss franc in Asia Thursday, as suspicions grew that the latest attempt by central banks to save the sliding U.S. economy won't work.

Market participants ranging from hedge funds to bankers to Japanese exporters sold the dollar for yen, sending it as low as ¥99.77 on the EBS trading platform, before bouncing back to ¥100.18. That was the lowest level since ¥99.94 on Nov. 10, 1995.

The dollar also sank to all-time lows of $1.5587 per euro and 1.0090 versus the Swiss Franc. Against the British pound, the U.S. currency fell to $2.0321 -- the lowest since Dec. 14, 2007.

The dollar fell so quickly that Japan's finance minister and his top subordinate warned the markets against causing "excessive" moves in the dollar-yen rate -- a language that indicates they are increasingly concerned about the rising yen damaging Japan's slowing economy.

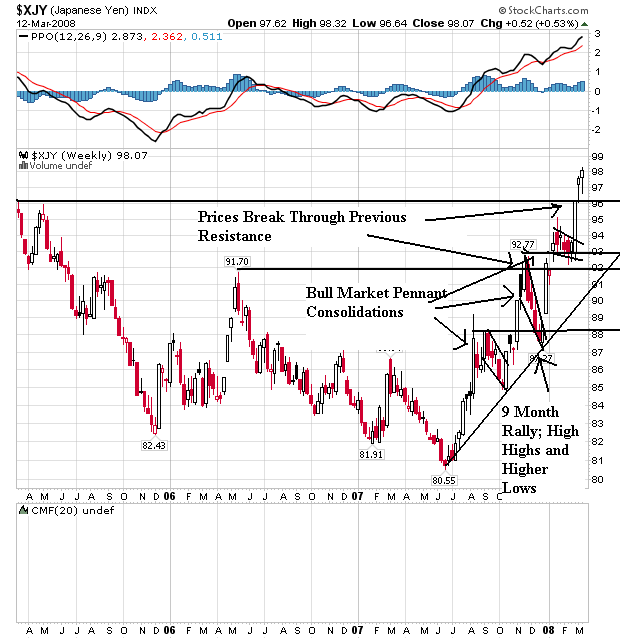

On the weekly yen chart, notice the following:

-- Prices made a preliminary bottom in late 2006 and then made a stronger bottom in mid-2007.

-- Since the bottom in 2007 the yen has risen about 20%.

-- The upward move of the last 9 months is at a sharp angle

-- Prices continually broke through previous resistance levels.

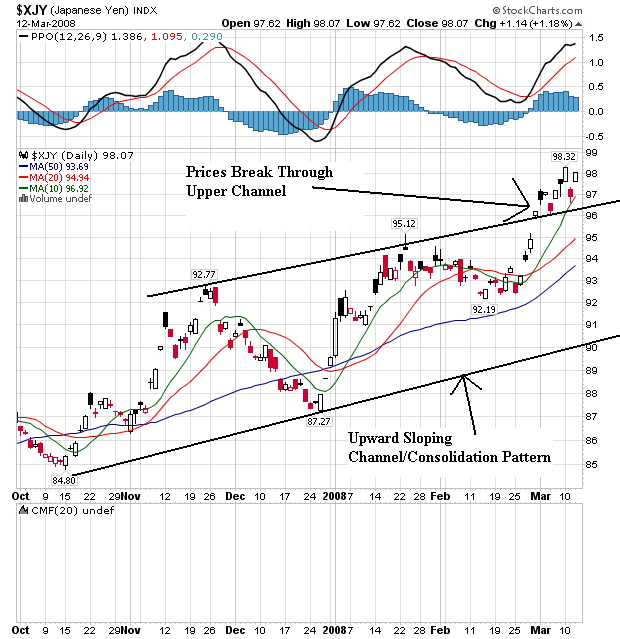

On the daily chart, notice the following:

-- Prices just spent about 4 1/2 months in an upward sloping consolidation pattern.

-- Prices are using the 10, 20 or 50 day SMA as support

-- Notice the orderly rise and fall of prices; there aren't any sudden moves in either direction. This is a market that so far knows where it wants to go.

-- Prices are in a higher higher, higher low pattern right now.