1.) Inflation expectations. Higher inflation decreases the value of a fixed income stream and lower inflation increases the value of a fixed income stream. So if investors expect higher inflation they should sell treasuries.

2.) Interest rate policy: If the Fed is lowering interest rates than bonds issued before the rate reduction at a higher interest rate become more valuable. The inverse is also true.

3.) Flight to quality: in uncertain times investors seek the safety of US government debt.

4.) Overall interest rates on the bonds. Remember that prices are constrained on the upside by the interest rate of a particular bond. Although a bond can theoretically go to 0% interest, that would only really occur in a very limited set of circumstances.

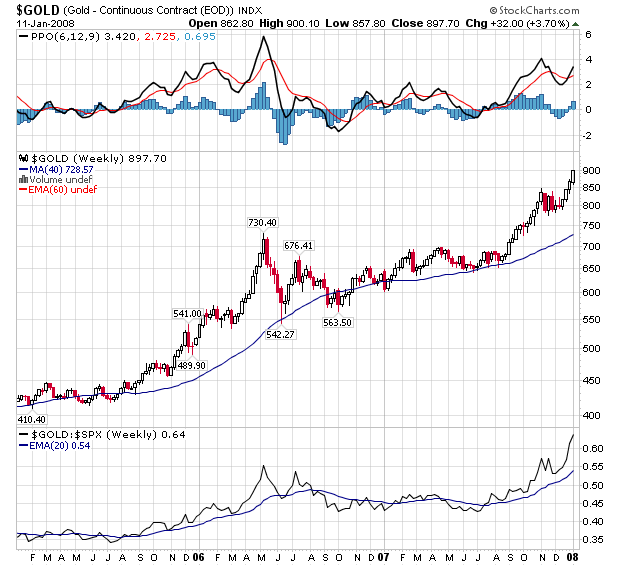

Remember that gold is spiking right now, indicating inflation expectations are pretty high:

Yet Treasuries are still in a rally. Here is a chart of the 7-10 year Treasury ETF:

That means the "flight to safety" trade is probably dominating.

The same holds for the 20+ year Treasury market:

I bring this up because tomorrow we get PPI and Wednesday we get CPI. Will the news be bad enough to to start a sell-off in the Treasury market?