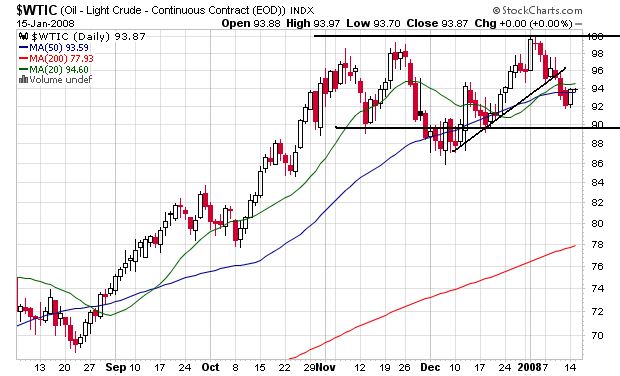

On the daily chart, we have a clear consolidation pattern between roughly $90 and $100. On the bullish side we still have (and will continue to have for the foreseeable future) a huge increase in demand as India and China continue to grow. On the bearish side we have a possible US recession. However, I have to wonder

1.) How much a US recession would really impact US demand, and

2.) If the increased demand from India and China would compensate for the decrease demand from the US if we have a recession.

I don't have a firm answer to #2, but I have a sneaking suspicion that the answer is the new demand would be pretty strong.

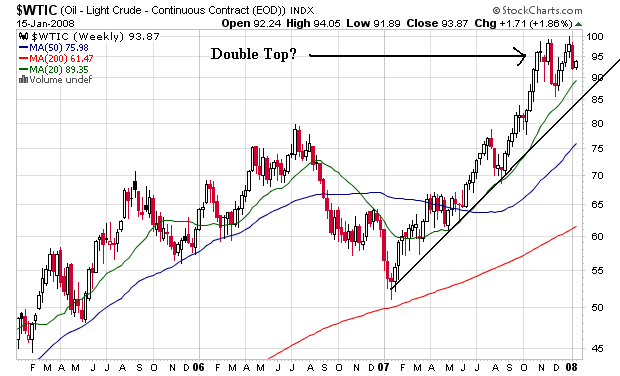

On the weekly chart, we still have an uptrend but a possibility of a double top forming. I don't think a retreat from this level would represent the fact that demand is dropping as much as it would represent profit taking.