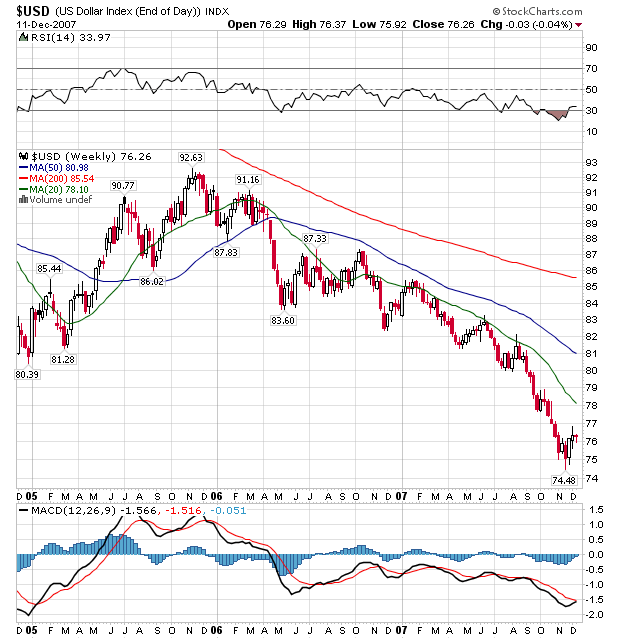

The dollar is still in a downtrend, oil is still high and the Federal Reserve is looking like they are behind the curve. Housing is still a huge problem, corporate earnings are not good, and confidence is low

Here are some charts to demonstrate those points:

The dollar has been dropping for almost two years. With the Fed loosening monetary policy I wouldn't expect this trend to change.

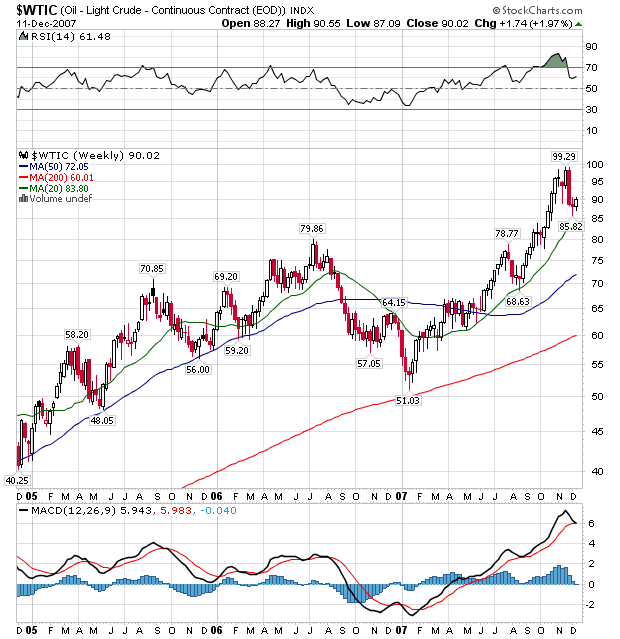

Oil's been rising for about three years. The Fed mentioned the effect of high oil prices in their statement yesterday.

Readings on core inflation have improved modestly this year, but elevated energy and commodity prices, among other factors, may put upward pressure on inflation. In this context, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

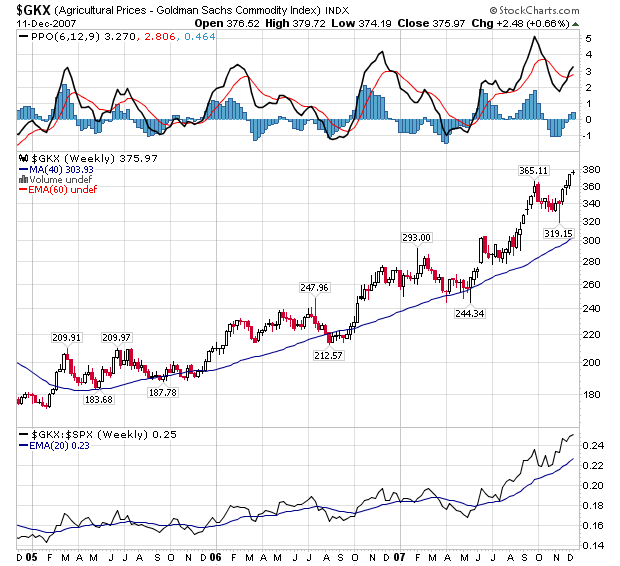

While I didn't mentioned food prices, they've been rising as well.

That's three years of price increases.

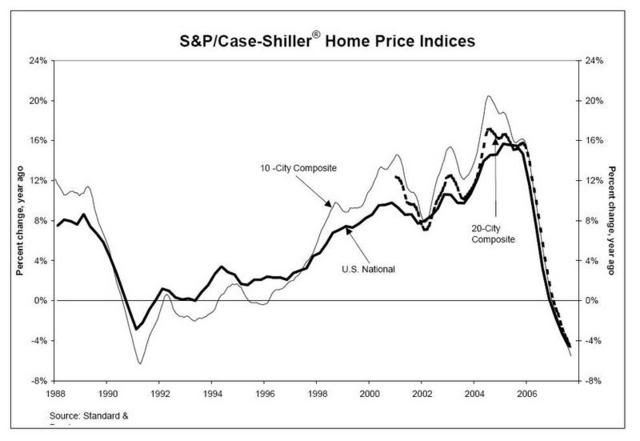

Do I really need to go into housing? OK -- how about home prices?

'Nuff said.

Corporate profits are dropping

Here are some confidence charts.

The above is a chart of CFO confidence.

There is no silver lining in any of these data points; they are each negative in their own right. Combined they paint a very disturbing picture.