Wheat prices rose to a record, passing $9 a bushel in Asian trading, on concerns that declining global output will further shrink inventories at a 26-year low.

Reserves of the grain in Canada, the world's second-largest wheat exporter, plunged 29 percent at the end of July from a year earlier, Statistics Canada said yesterday. The U.S. may cut its forecast for the crop in Australia to 18 million tons, from 23 million metric tons in a report today.

Wheat prices have more than doubled in the past year, raising costs at companies such as Premier Foods Plc, the U.K.'s biggest maker of cakes, Nissin Food Products of Japan and Sara Lee Corp. The grain is used as livestock feed and to make cakes, noodles and bread, with one bushel enough to make 73 loaves.

``It is feeding through to the consumer, it's gone up high enough to do that,'' said Tobin Gorey, commodity strategist with Commonwealth Bank of Australia Ltd. in Sydney. ``The market is in a real frenzy. The news flow continues to be negative.''

Here's a chart of wheat. Notice it has really started to spike over the last few months.

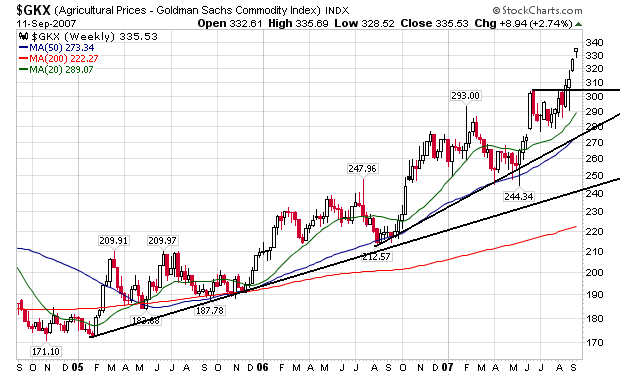

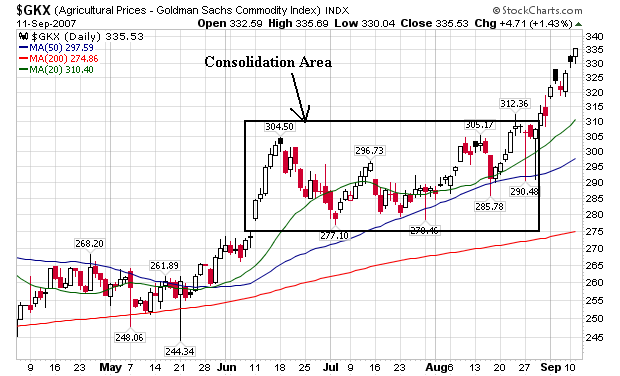

Here's a chart of the Goldman Sachs Agricultural Index. It consolidated earlier this year and then started to move higher.

And notice on the weekly chart we have a two year continual uptrend.