Retailers were projected to post decent sales gains for July, but results came in weaker than expected amid soft sales at apparel shops.

Department stores were slated to report solid growth amid calendar shifts skewing comparisons, but instead posted mixed results. In the discount sector, industry leader Wal-Mart Stores Inc., whose 1.9% same-store-sales increase came in at the high end of expectations.

Seven of the nine chains in Thomson Financial's teen/child category reported weaker-than-expected results.

From CBS.Marketwatch:

With nearly half of the nation's major retailers reporting sales results to Thomson Financial, 75% have missed Wall Street's expectations. Analysts had been expecting that sales at stores open longer than a year, the industry's most important measure, would be weak, particularly among teen and women's-wear retailers.

But the early results suggest that consumers across the board are far more concerned about credit and financing woes sparked by the slowdown in the housing market and the collapse of the subprime mortgage business.

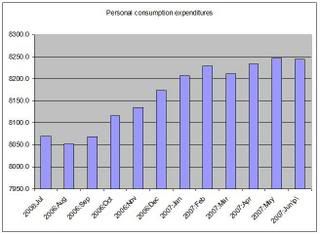

Here's a chart of chained 2000 monthly personal consumption expenditures at seasonally adjusted annual rates. These reports should surprise no one.