"The long-term story for the base metals remains the same: Demand for metals continues to increase steadily," said Lawrence Roulston, editor of Resources Opportunities. Meanwhile, "production growth is constrained by the long lead times to develop new production and by the shortage of high-quality development projects."

"All metals have small inventories, which means any supply disruption can lead to a price bump," said Dr. Harlan Meade, president and chief executive officer of both Selwyn Resources Ltd. (CA:SWN: news, chart, profile) and Yukon Zinc Corp. (CA:YZC: news, chart, profile).

Base metals are even likely to find support from the rally in oil prices, "since the principle in economics is simply supply/demand fundamentals," according to Cary Pinkowski, chief executive officer of Vancouver, Canada-based CP Capital Group and director of Centrasia Mining

This has been a constant theme of the last few years. With China growing at high rates and India not far behind, demand for metal and other raw materials continues to increase. Here are some charts from Futures Charts.

Copper

Copper sold off at the end of 2006. However, demand pick-up again in 2007, and the metal has been rallying since. Since April it has been consolidating in a triangle formation.

Palladium

Palladium has had a slow and steady price increase since October of last year. That's a 10-month rally, which indicates the strength of the underlying increase in demand

Gold

Gold had a 6 month rally starting in October of last year. For the last three months it has been consolidating in a triangle formation.

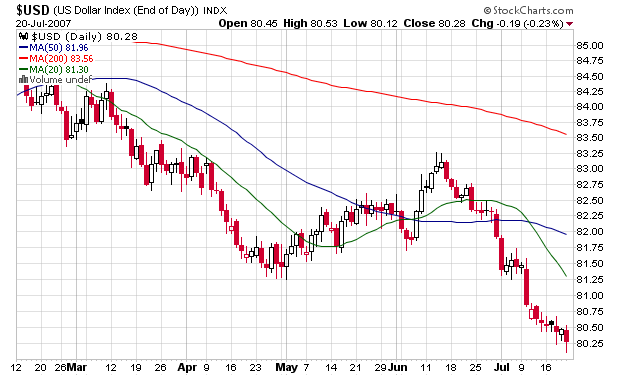

Keep an eye on the dollar's level. As the dollar approaches the $80 level it may apply upward pressure to gold.

Silver

Silver rallied starting in June of last year. Since April it has been consolidating in a slightly downward forming triangle pattern.

Aluminum

Aluminum is the one metal that hasn't had a strong rally. Instead, it's price has been near constant for the last year or so. However, note that it's price is still high on the chart, indicating demand is still higher now than it was a year or so ago.