``It's a story of heightened risk aversion,'' said Sue Trinh, a strategist at RBC Capital Markets in Sydney. ``The market is jittery that it's not contained to the U.S.''

Investors, whose confidence has been sapped by losses from subprime mortgages, are balking at absorbing more risky debt. More than 40 companies reworked or abandoned bond offerings in the past three weeks. The retreat forced banks to take on at least $32 billion of risky debt and threatens to bring an end to a record run for leveraged buyouts, which surged to a total $690.4 billion of deals this year.

``You have a stampede of the animals away from the watering hole,'' said Scott MacDonald, director of research at Aladdin Capital Management in Stamford, Connecticut, which manages about $20 billion in assets. ``Right now, everything that smacks of financial risk is backing out through the door.''

Let's translate the above eco-geek talk. Borrowers have gotten away with financial murder over the last few years. Lenders stopped asking for loan documentation and instead simply checked to see of a borrower had a pulse. Loan covenants went away or became incredibly lax. A loan covenant is a condition of the underlying loan. For example, a lender might stipulate that a borrower always have x% of his assets in liquid assets, or that the borrower always have X percentage of assets to liabilities, or any other of a number of other conditions regarding the loan. These conditions either ceased to exist, or were so lax that they essentially meant nothing.

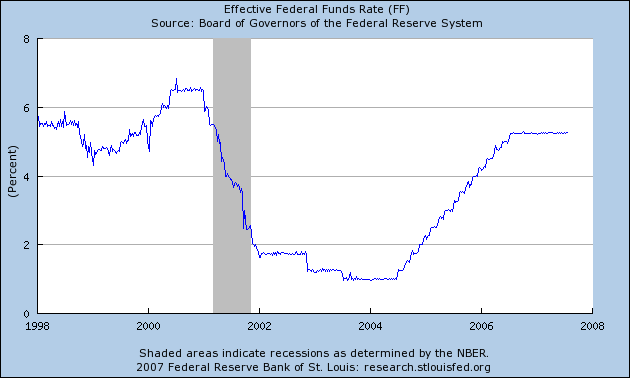

The main reason this happened is easy credit. In the early 2000s, the Federal Reserve lowered interest rates to historically low levels. Here's a chart from the St. Louis Federal Reserve of the effective federal funds rate for the last 10 years.

Notice the rate was lower than 2% for 2 and a half years. This is the financial equivalent of lenders giving money away. From a negotiating perspective, record low rates give borrowers the advantage. A borrower can go to a lender and say "I'll give you x% over the prevailing rate, but you can't include really strenuous terms in the loan." When the borrower makes this offer, the lender is making loans at really low rates. Therefore it's harder to make money. When a borrower says "I'll concede a higher interest rate it you make the terms easier" the lender is more than likely to take the deal.

This has been the prevailing credit market sentiment for the last 5-6 years. Borrowers have been in control. This has led to the subprime problem in the housing market. Now that loose credit standards are starting to take their toll everyone is taking a step back to evaluate the situation.

However, the overall situation is nowhere near Armageddon levels.

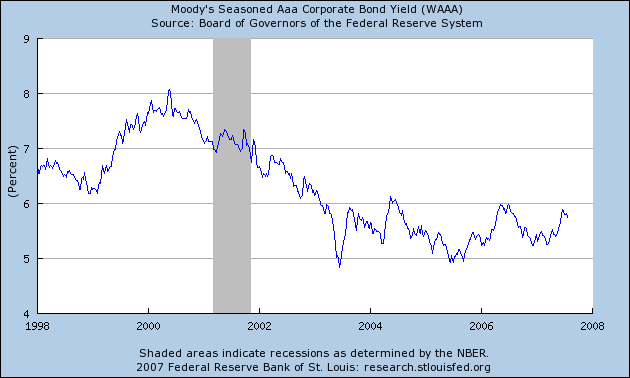

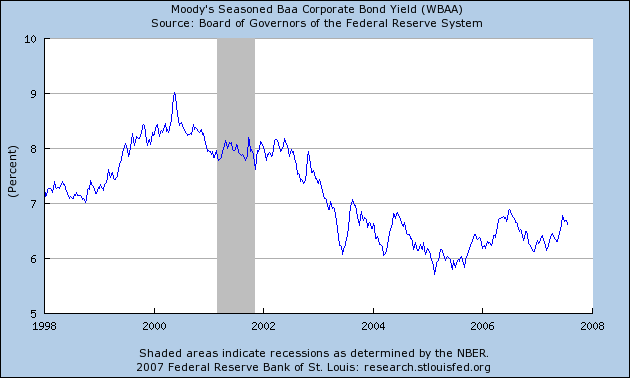

First, overall interest rates aren't that high. Here is a chart of the AAA corporate interest rate followed by the Baa corporate interest rate.

Notice that while interest rates have gone up, they're not that high. AAA paper is a little below 6% and Baa paper is about 6.5%. Simply put, this isn't that high. Even if AAA paper increased to 6.5%, the rate would still be pretty low. The point here is interest rates were higher at the end of the 1990s and the economy still hummed along just fine.

It's also important to note that banks are in pretty good shape. Here are some charts from the latest FDIC quarterly report.

First, the non recurrent loan rate is pretty low.

Quarterly net-charge offs

Quarterly Change in Non-recurrent loans

From the financial side of the market, this is the first quarter when financial companies have stated that loan losses are increasing. That has everybody understandably spooked. However, as the above charts indicate, loan losses are pretty low and would have to increase pretty substantially before the financial companies were in terrible shape. That does not mean things are all rosy; but things are not all terrible either.

Most of what is happening right now in the credit markets is a reevaluation of credit risk. As firms and businesses go through this reevaluation they will stop all business. However, once this reevaluation is over, the chances are things will move forward albeit it at a slower pace. I would expect this process to last through the end of this year with credit becoming more available by the first quarter of 2008.