Here is some interesting commentary from last week's Barron's (subscription required):

In a replay of tariffs slapped on steel imports in 2002, the Commerce Department said it would impose tariffs of 10.9% to 20.4% on Chinese coated papers in retaliation for subsidies Beijing provides. The dollar reacted negatively to the protectionist measure, which recalls the currency's drop in the wake of the steel tariffs. Although later reversed by the World Trade Organization, those levies helped set off a 35% decline in the dollar against the euro in the following year, writes Ashraf Laidi, CMC Markets' chief foreign-exchange analyst.

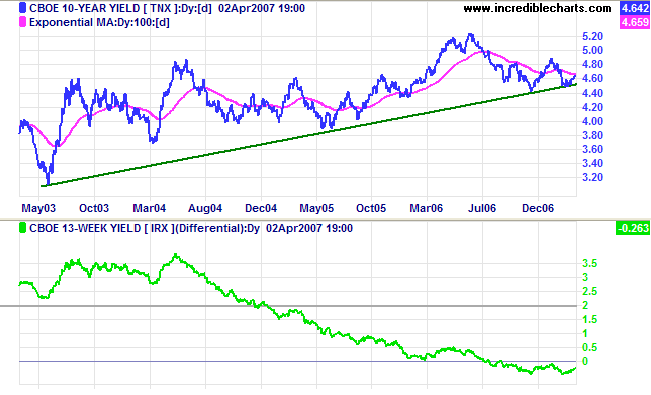

Whether or not these new tariffs also are reversed by the WTO, the U.S. actions could trigger retaliation by China, notably further diversification of its currency reserves, the vast majority of which are held in dollars in the form of U.S. bonds. As noted here several weeks ago, one academic study estimated that foreign-capital inflows have lowered long-term U.S. interest rates by 90 basis points (0.9%). All else being equal, less buying of U.S. assets would tend to boost yields.

These higher rates would pile onto the already staggering housing market. Higher inflation resulting from the tariffs and the weaker dollar would add to pressure on the Federal Reserve not to lower rates to offset the effect of a housing slide on the economy, according to T.J. Marta, fixed-income strategist for RBC Capital Markets.

China and the US are in a mutually beneficial relationship; we buy their products, they loan us money.

In addition, China and the US are involved in a currency version of Mutual Assured Destruction. While I have expressed concern about the US/China relationship many times -- and am still concerned -- a move by the Chinese to dump dollars would devalue about $1 trillion in assets held by the central Chinese Bank. In short -- it would hurt them as well.

That does not mean we should not be concerned about China's international reserves. the trade deficit is indicative of a massively imbalanced international trading system. However, calls for monetary collapse based in this situation aren't 100% on the money.