- by New Deal democrat

I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of stress. This is because the long leading indicators were negative one year ago, and many - but not a majority - of the short leading indicators have recently turned negative as well. So I have been on “recession watch.” But no recession is going to begin unless and until layoffs increase.

To reiterate, my two thresholds are:

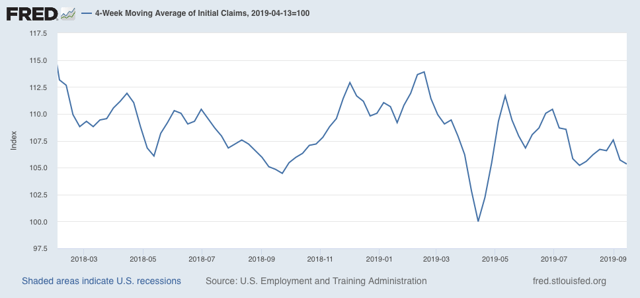

1. If the four week average on claims is more than 10% above its expansion low.

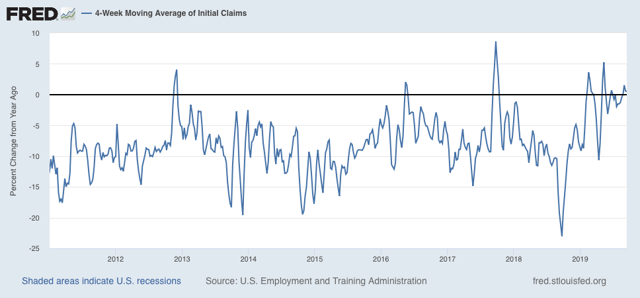

2. If the YoY% change in the monthly average turns higher.

As of this week, initial claims continue to be very close to their expansion lows. The 4 week moving average of claims as of this morning is 212,500, only 11,000, or 5.3%, above the lowest reading this expansion:

On a YoY% change basis, the 4 week average is 0.6% higher than one year ago:

But September claims so far are running -5000 less than the full month of September 2018.

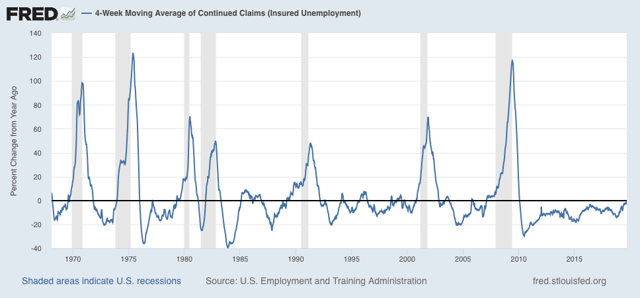

The less volatile 4 week average of continuing claims is also running -1.3% below where it was a year ago:

Initial claims continue to be an important positive in the short term forecast. If a recession doesn’t happen within the next 6 months, it is hard to imagine it happening at all through 2020 (with usual caveat: *IF* the economy is left to its own devices). And initial claims increasingly suggest that a downturn will not happen within that 6 month window.