- by New Deal democrat

Industrial Production is the King of Coincident Indicators. When industrial production peaks and troughs coincides more often than any other indicator to NBER’s recession dating. Let’s take a look at the report for August, which was pretty darn good, which was released this morning.

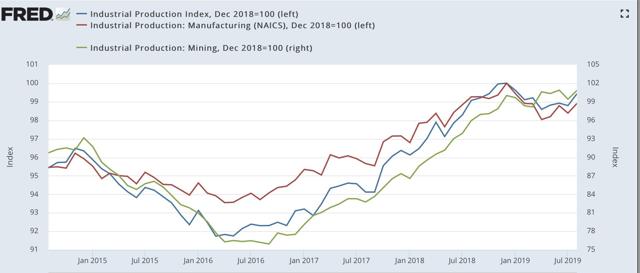

Production as a whole increased 0.6%, and last month’s report was revised upward by +0.1%. The manufacturing component also increased, by 0.5%. Both, however, are still below their peaks set last December (left scale in the graphs below). The other important component, mining (which includes oil production) increased 1.4%, reversing July’s decline, missing a new high by less than 0.1% (right scale):

Stepping back for a longer term look, here is the same graph including the “shallow industrial recession” of 2015-16:

The main difference between the two periods is that the more volatile mining (oil and gas) sector declined by almost 23% in 2015-16, but has continued to increase this year. Manufacturing, which declined about 3% in 2015-16, declined 2% at its worst point this year. Overall industrial production declined by -5% in 2015-16, but only declined -1.4% at its worst point in April of this year.

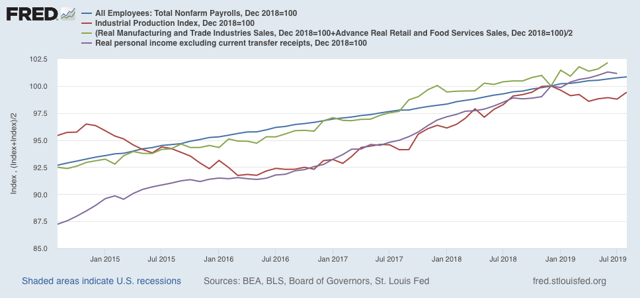

Here is the update on all of the four monthly indicators that the NBER has said it pays particular attention to in deciding whether or not there is a recession:

As in 2015-16, industrial production is the only one of the four which has declined this year.

In sum, production had a much more shallow decline this year than in 2015-16, and — so far — looks to be recovering from its trough in April. Once again the message appears to be: slowdown, no recession.