- by New Deal democrat

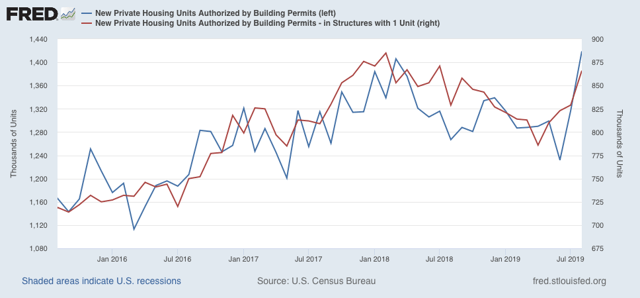

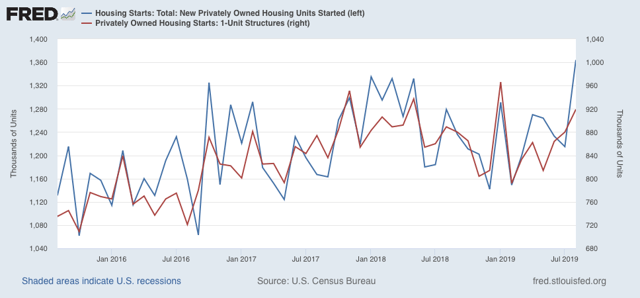

Well, this is an easy post. This morning’s report on housing permits and starts showed new expansion highs in both overall permits and starts. The less volatile single family segment also recovered, with both single family permits and starts at one year highs, although slightly below their expansion peaks.

Here are total and single family permits:

And here are total and single family starts:

The housing downturn is over. As expected, lower interest rates for the past eight months have shown up in the housing data in spades.

This has major implications for the index of leading indicators this month, which can be expected to pop. And since housing permits are a long leading indicator, this, along with new expansion lows in corporate bond yields, new highs in per capita real retail sales, renewed increases in real money supply, and continuing looseness in credit conditions, means that the only negative long leading indicator is the partially inverted yield curve, and the only mixed or neutral indicator is corporate profits. In short, the latter part of next year is shaping up to be quite positive.

In the immediate term, I wonder if this takes the pressure off the Fed to lower interest rates. If you are a Democrat, don’t hang your hat on there being a recession on Election Day next year (although “Tariff Man” may yet come through!).