Despite having a very weak economy, the yen actually strengthened over the duration of this expansion because of Japan's safe haven status. In fact, from the yen's ETF's lows in 2008 to its highs in 2011, it gained a little over 32%. However, since the end of last year and the introduction of "Abenomics" (which includes yen devaluation to increase the competitiveness of Japan's exports) the yen's ETF has dropped almost 26%. The end result is an increase in exports, as shown in this excerpt from the latest BOJ Central Bank Meeting Minutes:

Exports had been picking up. Real exports had turned upward in the January-March quarter of 2013 and kept increasing in the April-May period relative to that quarter, after having continued to decline in the July-September and October-December quarters of 2012. Exports of motor vehicles and their related goods -- due in part to the effects of developments in foreign exchange rates -- had resumed an uptrend, assisted by a pick-up in those to China -- which had seen a significant drop -- while those to the United States and other regions had been steady. Exports of capital goods and parts as a whole had recently started to bottom out, with upward movements observed in exports to the United States and East Asia, disregarding the fluctuations in ships. Exports of IT-related goods as a whole appeared to be heading for a bottom, with the effects of the downshift in demand for parts for final products of smartphones -- which had taken place since the end of 2012 -- easing. Exports were expected to increase moderately, mainly against the background of the pick-up in overseas economies.

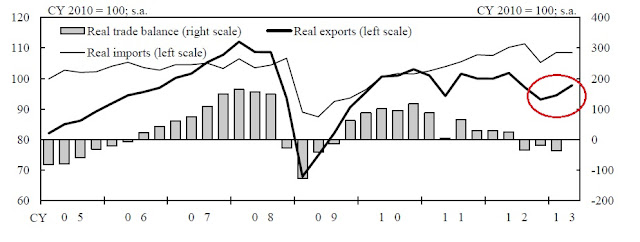

The latest exports release shows a 12% year over year increase. Here's a chart of total exports from the latest BOJ monthly economic report:

Exports are still weak, as they are in line with the numbers reported over the last 3-4 years. However, we do see the uptick that is mentioned in the BOJ minutes.