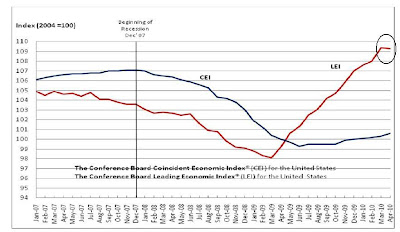

The Conference Board Leading Economic Index®(LEI) for the U.S. declined 0.1 percent in April, following a 1.3 percent gain in March, and a 0.4 percent rise in February.

Says Ken Goldstein, economist at The Conference Board: "These latest results suggest a recovery that will continue through the summer, although it could lose a little steam. The U.S. LEI declined slightly for the first time in more than a year, and its six-month growth rate has moderated since December. Meanwhile, the coincident index, a measure of current economic activity, has been improving since mid-2009."

Here's the chart:

Notice the chart has increased for the better part of a year, making this one month a "blip". However, this is a very good indicator with a good track record that can't be ignored. Here's the data for why the index dropped:

Manufacturer's new orders and supplier deliveries dropped. This is hits the manufacturing sector which has been a big part of the turnaround. Coordinate this data with the drop in the Empire State index (which dropped but is still positive) and a possible slowdown may be in the works (although today's Philly Fed was positive). Building permits are way down, impacting housing, construction employment and construction/home improvement retail (Home Depot, Lowe's etc.). Home retailers had reported some good numbers recently. Money supply dropped which hits everyone. Consumer expectations dropped, hitting retail sales.

So, we have one month of a drop, but the underlying reasons for the drop are pretty broad based. This, in conjunction with the rise in initial unemployment claims, raises a yellow flag until we get more data.