The biggest threat to ongoing economic recovery now is the biggest chronic problem for the middle/working classes for the last 45 years: a lack of real wage growth. This is something I first described a year ago. Only twice in the last 45 years has there been real, sustained wage growth (that is, wages growing faster than inflation) for more than a year or so: once, in the post-war economic golden era of the 1960s and early 1970s; and again during the tech boom of the 1990s.

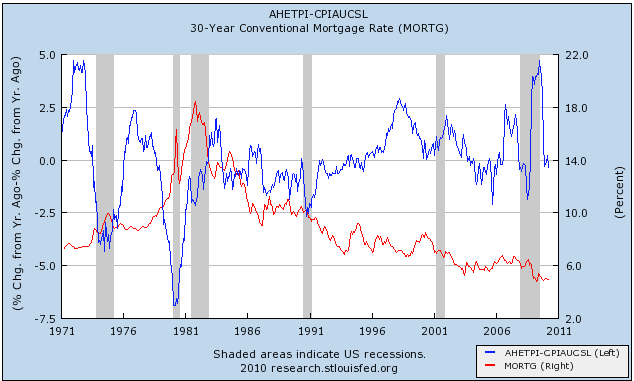

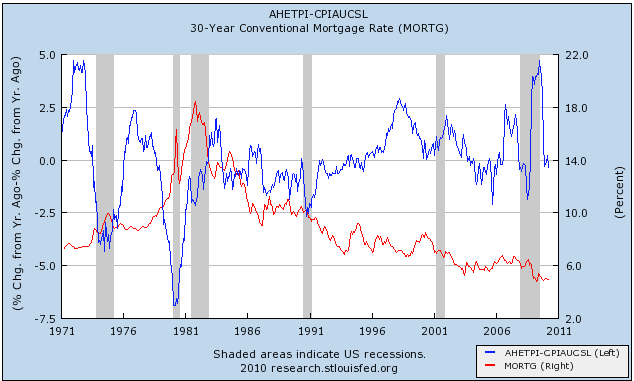

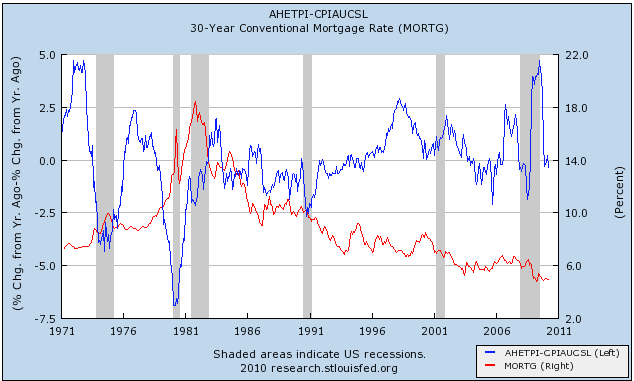

This is shown in the following graph. It takes average wages measured as year over year percentage change, and subtracts CPI. Thus, in those time periods where wage growth exceeded inflation are positive in the graph. Those where wage growth failed to keep even with inflation are negative:

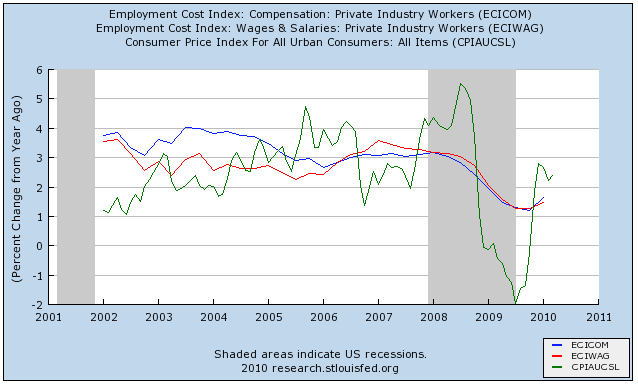

Because the above graph uses average (i.e., "mean" wages) it can be distorted by a few number of very high income workers. A better measure of wages is something called the Employment Cost Index, which measures income for the "median" (i.e., 50th percentile) worker. The problem with the ECI is that it os less than 10 years old. With that limitation, here is the same graph showing wage growth as measured by the ECI (red) and wages + benefits (blue) vs. the inflation rate (green):

Notice that the ending of the Great Recession was helped enormously by the fact that wages grew substantially faster than prices (which actually fell for a while).

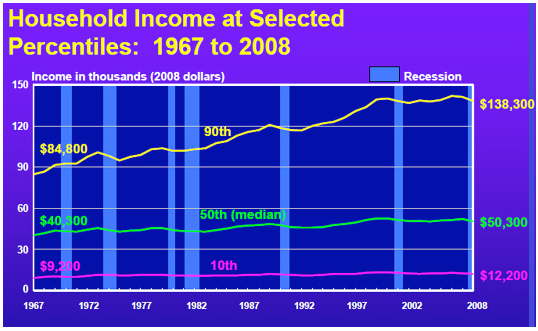

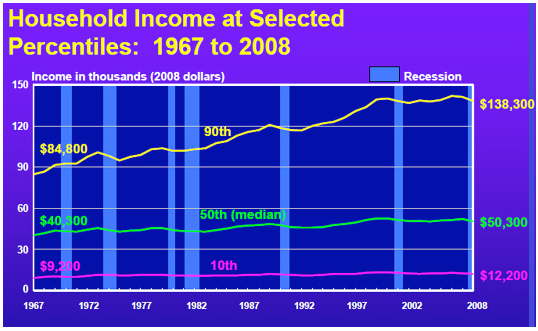

In the longer term, as you can easily see from the above graphs, real wage growth essentially stagnated in 1974, and ever since the Reagan revolution, almost all growth from productivity has been vacuumed up by the very top of the income scale:

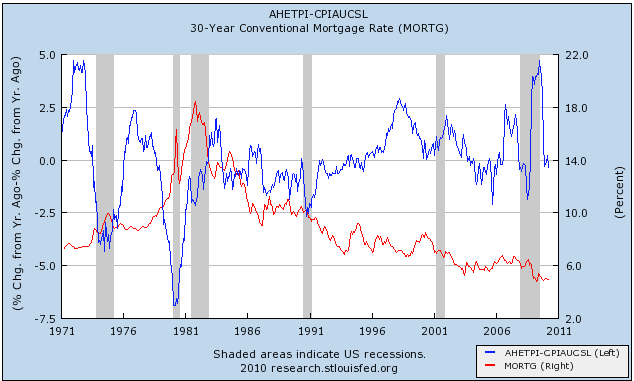

2. American consumers have coped in two ways

As the American middle/working classes have been relentlessly squeezed, they have coped with this stagnation by resorting to a small bag of budgeting tricks. Chief among those coping mechanisms has been that there has been a generation-long decline in interest rates since they peaked at 15.21% for the 30 year US Treasury bond in October 1981. This has allowed consumers to refinance their debts at ever lower rates every few years, specifically by refinancing their mortgages. Here is a graph which compares real wage growth (from the first two graphs above) and adding average mortgage rates in red:

2. American consumers have coped in two ways

As the American middle/working classes have been relentlessly squeezed, they have coped with this stagnation by resorting to a small bag of budgeting tricks. Chief among those coping mechanisms has been that there has been a generation-long decline in interest rates since they peaked at 15.21% for the 30 year US Treasury bond in October 1981. This has allowed consumers to refinance their debts at ever lower rates every few years, specifically by refinancing their mortgages. Here is a graph which compares real wage growth (from the first two graphs above) and adding average mortgage rates in red:

The graph shows that for most of the period of 1982-2007, mortgage rate declines were frequent enough for homeowners to refinanced their debt at lower interest rates, freeing up additional income for spending.

For awhile during the housing bubble, many people went further, taking equity out of their houses as they appreciated in value by way of home-equity loans (HELOCs). This of course came crashing down as thouse values vaporized, but the debts remained. Before that, in the 1980s and 1990s, some people were able to cash in on appreciation of stocks in their 401K's -- but of course that ended in the dot-com crash a decade ago.

3. When neither coping mechanism is available, recession has inexorably followed

I described this back in August 2007, I wrote a piece called Are Hard Times Near? The Great Decline in Interest Rates is Ending, in which I said:

In a follow up piece a few months later, entitled Why American Consumers are Signaling Recession I also pointed out that:

4. Wage growth is pathetic in this recovery

Now that we've looked at the long-term problem, let's describe the short term outlook.

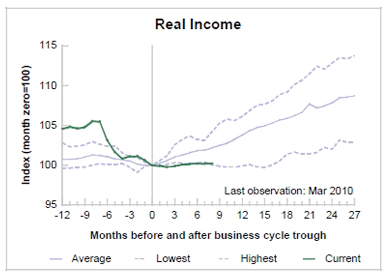

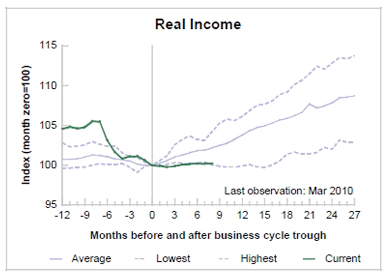

While all the other indicators of recovery have turned positive -- including, in the last few months, jobs -- real income is still limping along the bottom:

Because of this, the economic recovery is in a very tight spot -- precisely because average American consumers also remain in a very tight spot. Look again at the first two graphs above. They show wage growth of about 1.5% for the last year. Under those circumstances, even 2% inflation is too much for them to withstand -- without the ability to refinance debt, their disposable income simply isn't keeping up. Outright deflation too is bad, because it only occurs if there is a decrease in demand, causing general prices to go down -- in other words, it will only happen if the economy rolls over again and there are more layoffs, wage cuts, and higher unemployment.

5. No widely held middle-class assets are appreciating

So with paltry income increases of about 1.5%, there are only two ways to sustain the recovery for very long: (1) the inflation rate remains in a very narrow window of 0-1.5%; (2) some asset held widely by average consumers appreciates in value. or (3) another opportunity arises to refinance mortgage debt.

I thik we can all agree that number (2) doesn't look like it's going to happen. That leaves either number (1) or number (3).

6. What about refinancing at lower interest rates

As it happens, lo and behold, a window of opportunity in mortgage interest rates has opened: since the end of 2008. Here's the graph of mortgage rates overlaying real wage growth again:

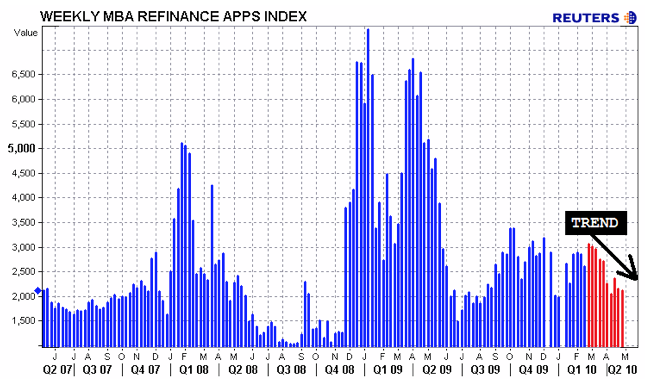

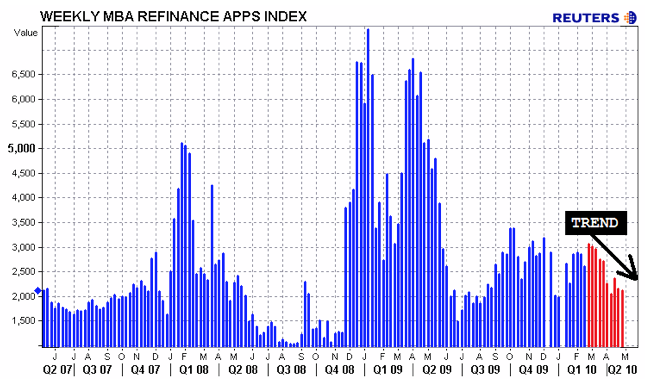

Note that mortgage rates went under 5% for the first time at the end of 2008, and have stayed close to that rate since. Since that time, mortgage refinancings have risen, and have remained at least somewhat ahead of their 2008 nadir, although with rates rising over 5% in the last couple of months, as the graph below indicates, in the short term refinancings have fallen somewhat again:

7. The price of Oil in particular determines if inflation can remain in the "sweet spot" given low wage growth

Further, as indicated above, only a very narrow window of inflation is helpful to the recovery, and if the unlikely event of decent wage increases doesn't happen, that kind of extremely tame inflation is dependent most of all on energy prices. They have gradually risen in the last year to the poitn where they are within 0.1% of the 4.0% of GDP level (or 6% of disposable income) where historically they have triggered a recession, as shown from this graph current through February 2010:

With the problems in Greece in particular and Europe generally, the dollar has strengthened, and this has cause the price of Oil to decline from over $85 a barrel to $70 a barrel in only one week. Should that decline last for awhile, it will take a little pressure off the consume, and allow inflation to return to that very narrow "sweet spot" which will keep consumer spending -- the biggest engine of economic growth -- positive.

8. This is a very small needle to thread --> so the biggest danger to sustaining the recovery.

But the fact remains that, from here on, we're not going to see any sustained recovery, no long term growth in the American economy until average Americans see a real and sustained increase in their compensation for labor -- for the first time in over 35 years. So long as real wages remain stagnant, any recovery which might start will be vulnerable to every uptick in inflation -- particularly increases in energy prices -- and interest rates. Without real and sustained wage growth -- without addressing the structural issues faciing the American middle/working classes -- recessions will be more frequent and deeper, and recoveries including this one will have problems being sustainable for too long a period of time.

3. When neither coping mechanism is available, recession has inexorably followed

I described this back in August 2007, I wrote a piece called Are Hard Times Near? The Great Decline in Interest Rates is Ending, in which I said:

In other words, since 1980, facing stagnated real wages, the only way American consumers have been able to significantly improve their lifestyles is either:

- to take on more debt, using assets which have appreciated in value as collateral (stock investments, housing), or

- to refinance their existing debt at lower interest rates.

When consumers were unable to do either of those things, they cut back on spending, triggering consumer-led recessions.

In a follow up piece a few months later, entitled Why American Consumers are Signaling Recession I also pointed out that:

You can see that for long periods of time in the 1980s, 1990s, and 2000s, consumers were able to spend more by refinancing their existing debt at lower interest rates. By contrast, when interest rates were stable, or even rising as in the 1970s, and wages failed to keep up with inflation, a recession ensued within several years (the only exception was the Y2K recession, which wss investment/tech led and was not a consumer recession)....That's exactly what happened as squeezed consumers cut back, their ability to refinance debt terminated by the collapse of the housing bubble.

Only twice in the last 27 years has the consumer been unable to refinance debt or tap into his or her stock or house ATM. ... [T]he 3rd and final time is almost certainly near.

4. Wage growth is pathetic in this recovery

Now that we've looked at the long-term problem, let's describe the short term outlook.

While all the other indicators of recovery have turned positive -- including, in the last few months, jobs -- real income is still limping along the bottom:

Because of this, the economic recovery is in a very tight spot -- precisely because average American consumers also remain in a very tight spot. Look again at the first two graphs above. They show wage growth of about 1.5% for the last year. Under those circumstances, even 2% inflation is too much for them to withstand -- without the ability to refinance debt, their disposable income simply isn't keeping up. Outright deflation too is bad, because it only occurs if there is a decrease in demand, causing general prices to go down -- in other words, it will only happen if the economy rolls over again and there are more layoffs, wage cuts, and higher unemployment.

5. No widely held middle-class assets are appreciating

So with paltry income increases of about 1.5%, there are only two ways to sustain the recovery for very long: (1) the inflation rate remains in a very narrow window of 0-1.5%; (2) some asset held widely by average consumers appreciates in value. or (3) another opportunity arises to refinance mortgage debt.

I thik we can all agree that number (2) doesn't look like it's going to happen. That leaves either number (1) or number (3).

6. What about refinancing at lower interest rates

As it happens, lo and behold, a window of opportunity in mortgage interest rates has opened: since the end of 2008. Here's the graph of mortgage rates overlaying real wage growth again:

Note that mortgage rates went under 5% for the first time at the end of 2008, and have stayed close to that rate since. Since that time, mortgage refinancings have risen, and have remained at least somewhat ahead of their 2008 nadir, although with rates rising over 5% in the last couple of months, as the graph below indicates, in the short term refinancings have fallen somewhat again:

7. The price of Oil in particular determines if inflation can remain in the "sweet spot" given low wage growth

Further, as indicated above, only a very narrow window of inflation is helpful to the recovery, and if the unlikely event of decent wage increases doesn't happen, that kind of extremely tame inflation is dependent most of all on energy prices. They have gradually risen in the last year to the poitn where they are within 0.1% of the 4.0% of GDP level (or 6% of disposable income) where historically they have triggered a recession, as shown from this graph current through February 2010:

With the problems in Greece in particular and Europe generally, the dollar has strengthened, and this has cause the price of Oil to decline from over $85 a barrel to $70 a barrel in only one week. Should that decline last for awhile, it will take a little pressure off the consume, and allow inflation to return to that very narrow "sweet spot" which will keep consumer spending -- the biggest engine of economic growth -- positive.

8. This is a very small needle to thread --> so the biggest danger to sustaining the recovery.

But the fact remains that, from here on, we're not going to see any sustained recovery, no long term growth in the American economy until average Americans see a real and sustained increase in their compensation for labor -- for the first time in over 35 years. So long as real wages remain stagnant, any recovery which might start will be vulnerable to every uptick in inflation -- particularly increases in energy prices -- and interest rates. Without real and sustained wage growth -- without addressing the structural issues faciing the American middle/working classes -- recessions will be more frequent and deeper, and recoveries including this one will have problems being sustainable for too long a period of time.