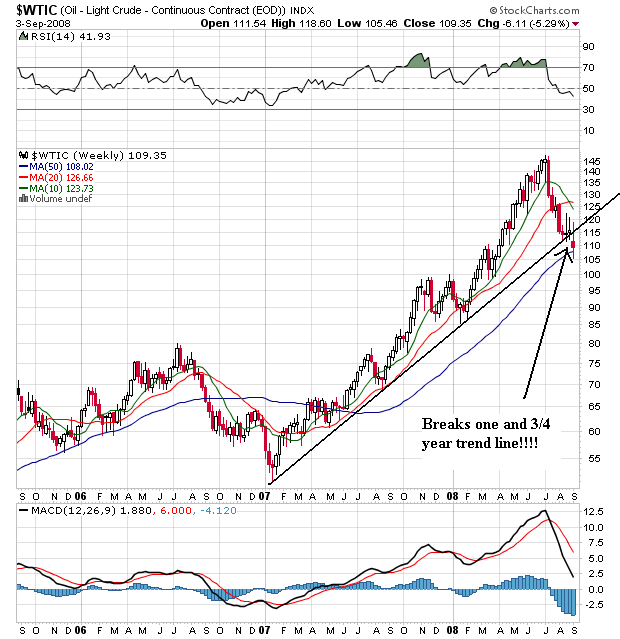

Oil broke the trend line that started in early 2007. That's a very important technical development because it signals the possible end of that rally. I say possible because we need further confirmation of the trend break. In other words, further downward price movement is necessary.

Also note that prices are right at the 50 week SMA. This is in effect the last stand of oil's rally. If prices stay above the 50 week SMA, use it for technical support and then bounce higher, then the rally may continue. But we're also in a very difficult rallying position from a fundamental perspective -- the US is in a recession and the rest of the world is starting to follow suit.

Also note the following:

-- The 10 week SMA has moved through the 20 week SMA and continues to head lower

-- The 20 week SMA is starting to turn negative

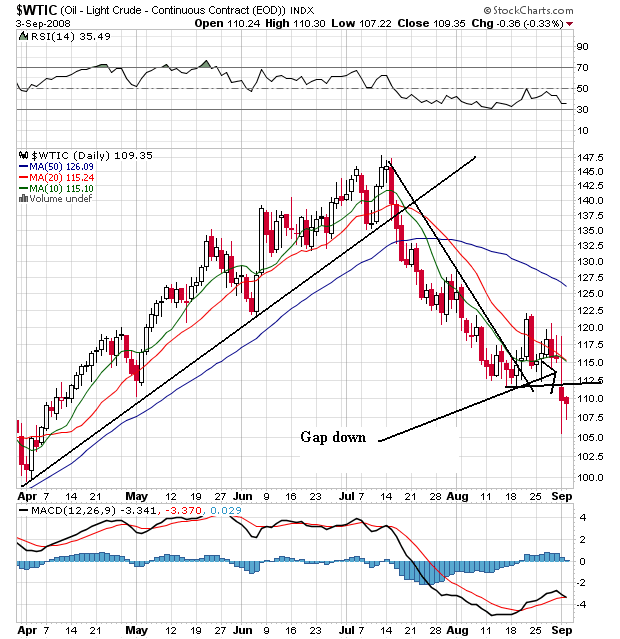

On the daily chart, notice the following:

-- All the SMAs are moving lower

-- The shorter SMAs are below the longer SMAs

-- Prices are below all the SMAs

-- Prices took a big gap down a few days ago

This is now a bearish chart