First, I have been extremely concerned/bearish about this expansion since I first started writing about it over four years ago. What led to that concern was the incredible proliferation of debt at the personal and federal level combined with the lack of real income growth (income less inflation). My negativity was perhaps premature -- I was concerned at the height of the "boom". However, I could not and still cannot shake the deep concern I have for the actual "strength" of this economy.

The fundamental problems I see are outlined here:

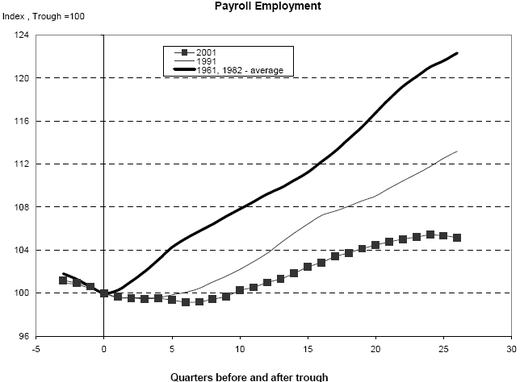

Job growth for this expansion is incredibly weak.

The above chart is from Barry over at the Big Picture blog. It shows that job growth from this expansion is the weakest of the last 40+ years. I recently got into an exchange with a more conservative person who made the observation that at the beginning of this expansion the unemployment rate was lower than at the beginning of other expansions. Therefore, the economy did not have to create near the number of jobs as other expansions in order to be productive.

One of the reasons I like to get into debates is the opportunity they provide to sharpen my analysis. And this was a good point. But after looking at the numbers, job growth is still paltry. I did the following "back of the envelope" calculations:

The latest expansion started in November 2001 (according to the NBER). At the end of 2001, there were 131,826,000 establishment jobs in the US. At the end of last year there were 137,623,000. That's a total gain of 5,797,000 over 6 years/72 months or 80,513/month on average. A conservative read of population growth/employment is it takes at least 100,000 month to absorb population growth. In other words, job growth didn't even keep up with population growth, let alone absorbing people who lost jobs back into the work force.

But even using your starting point, you get the following. There were 137,623,000 jobs at the end of 2007 and 129,999 at the end of 2003 for a total gain of 7,624. Divide that by 48 months and you get 158,833/month. This is barely more than population growth. either way, you have weak job growth and little reason for wages to increase because there is no lack of supply for employees.

Regrading the observations in the last paragraph, let's assume a more conservative need for population growth at 100,000. That means the economy only created on average 58,000 more jobs/month then needed to absorb population growth. That's just not enough to create enough of a labor shortage to increase upward pressure on incomes.

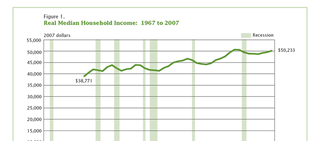

And incomes are ultimately what should increase when job growth increases. The equation is simple: when the economy starts really cooking, it creates more and more jobs. As this happens, fewer and fewer people are available for work. This leads to an increase in incomes as employers raise wages to attract new employees. But this has not happened during this expansion.

Above is a chart of real median household income from the Census Bureau. Note that wages haven't increased during this expansion, or as the Census Bureau put it in their latest report, the current level is "not statistically different from a 1999 pre-recession peak". And that's after 7 years of economic growth.

So far, we have weak job growth leading to stagnant median income. But people kept on spending for the duration of this expansion. Where did all the money come from?

Tons of debt. At the beginning of this expansion total household debt outstanding has increased from 7.6 trillion at the end of 2001 to 13.9 trillion in the first quarter of 2008. Put another way, total household debt is now almost as much as total US GDP (which was $14.3 trillion in the second quarter).

So we have the chimera of expansion. People kept spending, not because their incomes were increasing but because they were borrowing more and more to supplant their incomes. While we can get into a whole other side debate about whether or not that is a good idea, the basic point is clear. Easy credit was the primary driver of the latest expansion, not increasing incomes caused by solid job growth. And that's why the economy has never polled well despite the claims from the administration apologists. At some level, people know there is something off about the last 7 years.

On paper, the economy has grown. Economists can point to the raw data and say "we grew". That is not the question. The question is "how did we achieve that growth"? It wasn't from the growth in incomes. Instead it is from a ton of borrowing. And considering the credit melt-down we've had over the last year from excessively easy credit, maybe we need to ask ourselves if this is the best way to grow a country.