American International Group Inc. was facing a severe cash crunch as ratings agencies cut the firm's credit ratings, forcing the giant insurer to raise $14.5 billion to cover its obligations.

With AIG now tottering, a crisis that began with falling home prices and went on to engulf Wall Street has reached one of the world's largest insurance companies, threatening to intensify the financial storm and greatly complicate the government's efforts to contain it. The company is such a big player in insuring risk for institutions around the world that its failure could shake the global financial system.

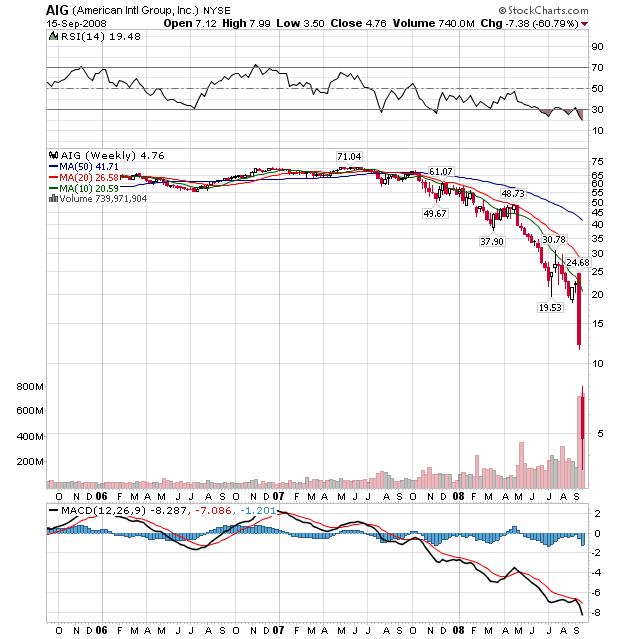

Shares of AIG fell 42% to $2.70 in recent premarket activity Tuesday after earlier in the premarket session rising 5% to $5. The stock tumbled 61% on Monday amid the U.S. stock market's worst daily point plunge since the first day of trading after the Sept. 11, 2001, terrorist attacks. In addition to AIG's woes, the financial markets were rattled by the rushed sale Sunday of Merrill Lynch & Co. to Bank of America Corp. and the bankruptcy-court filing of Lehman Brothers Holdings Inc.

Let's take a closer look at AIG:

The chart says traders think AIG is heading failure. Note the incredibly sharp drop that occurred in the latest week.

According to Reuter's income statement, AIG has lost money in the last two quarters.

According to Reuter's balance sheet, AIG has a positive net worth. However -- and as with all financial companies -- there is the issue of valuation of a long-term portfolio. For the last three quarters AIG has reported "long-term investments" of approximately $702 billion. The question is are these appropriate values for the investments involved? Considering all that we have seen over the last year, I would have to say these are not valued appropriately. I have no proof of that. However, I think the record of the entire financial sector is clear.

I should also add that I think the ratings agencies have absolutely no credibility right now. They gave great ratings to a lot of the paper that is currently blowing up all over the world. Simply put, the ratings system is completely broken.

The Federal Reserve hosted a meeting to discuss AIG's prospects at the central bank's offices in New York on Monday with company executives, bankers as well as state and federal officials

With strong encouragement from the Fed, Goldman Sachs Group Inc. and J.P. Morgan Chase & Co. are seeking to raise $70 billion to $75 billion in loans to help prop up AIG, according to people familiar with the situation. Word of AIG's efforts to borrow that much sent the stock market tumbling in the last hour of trading.

Who is their right mind would want to loan money to this company? They are losing money. Their ratings are being cut. The street thinks they will fail as evidenced in the stock price charts. Also note that Goldman and JPM are seeking to raise -- there is no mention of these companies contributing.

The bottom line, there is no way this happens without government back-stopping the deal.