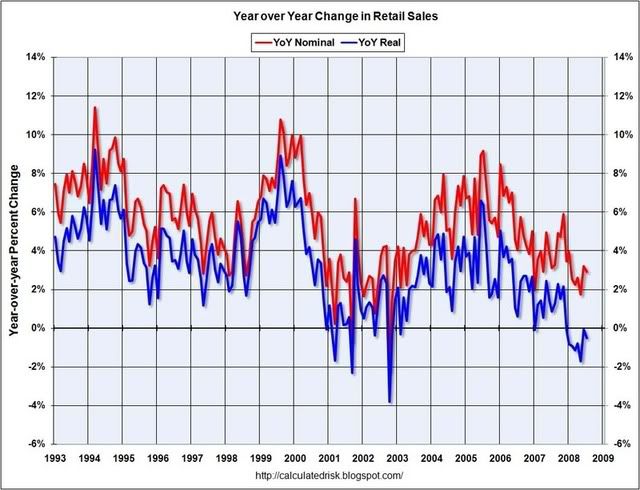

This chart is verified by the drop in personal consumption expenditures from the BEA's national income report:

Notice the following points:

-- Retail sales have been declining since the beginning of 2005 on a y/o/y basis.

-- Retail sales rate of y/o/y change has been negative for the entire year (that's 7 months). Remember that includes the stimulus checks. So even with free money, consumers aren't spending in strong enough patterns to raise retail sales into positive y/o/y territory. Let that sink in.

Let's add some possible reasons to the mix -- why aren't people buying more stuff?

Inflation is eating a larger percentage of their paychecks:

And today we learned that:

U.S. consumer prices climbed more than forecast in July, reducing the ability of the Federal Reserve to lower interest rates should the economic slowdown deepen.

The consumer price index climbed 0.8 percent, twice as much as anticipated, the Labor Department said today in Washington. The cost of living was up 5.6 percent in the year ended in July, the biggest jump in 17 years. So-called core prices, which exclude food and energy, also rose more than projected.

It's important to add that with the CRB index dropping (along with oil's price) this number should be coming down over the next 3-6 months. However, that raises a second set of questions. At what point is the price decline enough to warrant consumers increasing their purchases? Note that CPI's increase has taken a bigger and bigger bite out of paychecks over the last 6-12 months. At what point is a price drop sufficient to warrant an increase in confidence? Have the dynamics of the CPI's impact changed to where the drop has to be more pronounced and prolonged to increase retail spending?

The jobs picture has been deteriorating for the last two and a half years (and that's before we start to critique the birth/death model's laughable impact on the employment report). When jobs become less plentiful, people lose confidence and start to pull in their spending. Not only has the employment picture been declining for some time, but

The unemployment rate has been increasing for the last year and a half. And the situation is deteriorating:

More Americans than anticipated filed initial claims for jobless benefits last week, signaling further weakness in the labor market.

The number of first-time applications decreased by 10,000 to 450,000 in the week ended Aug. 9, from a revised 460,000 the prior week that was higher than previously estimated. The total number of people receiving benefits climbed to an almost five- year high.

Also note there has been wealth destruction in the US over the last year. We've seen the stock market drop along with the housing market. Neither of these developments encourages confidence. In fact, all of these events are leading to a big drop in consumer confidence.

So -- let's assume the best going forward. Even if the CPI starts dropping in the next 3-6 months (which it will if the CRB continues to weaken or remains at current levels) we still have a deteriorating situation in

-- employment (leading to a decline in income),

-- the real estate market (leading to an overall decline in wealth), and

-- the stock market (leading to a decline in wealth).

None of the preceding three situations will positively impact consumer sentiment going forward.

Therefore, retail sales probably won't be doing that well over the next few months.