"We established that the Fed was going to backstop the markets, keep things stable and slowly but surely nurse the markets back to health," says Daniel Shackelford, a portfolio manager at T. Rowe Price Group Inc. As a result, "risk-taking has come back in the market."

There remain significant trouble spots. The market for short-term loans between banks remains highly fragile. Other markets for complex debt instruments -- such as auction-rate securities, which help finance municipalities and student lenders, or collateralized debt obligations, which bundle together mortgage and other debt instruments -- have been deeply damaged by the crisis. Banks and brokerage firms are still sitting on piles of bad debt that could result in more losses.

"We still have some tough times ahead," says Alex Roever, credit strategist at J.P. Morgan Chase.

In the broader economy, housing, the trigger to the crisis, shows no sign of having hit bottom. Meanwhile, a consumer-spending pullback could be accelerating as households are pinched by rising gasoline prices, falling home prices and a sinking job market.

"The trick for investors is to figure out whether what they are seeing is a mirage," says Jason DeSena Trennert, chief investment strategist at Strategas Research Partners LLC. For example, he says the benefits of $100 billion of fiscal stimulus about to hit the economy could quickly fade.

Since the Fed

First, housing is nowhere near bottom.

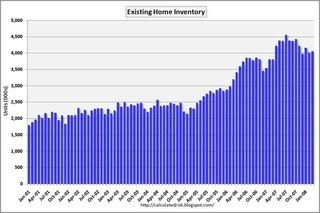

Let's start with supply. First, there are a ton of existing homes on the market -- right around 4 million (charts are from Calculated Risk).

And this is before we get into the issue of foreclosures.

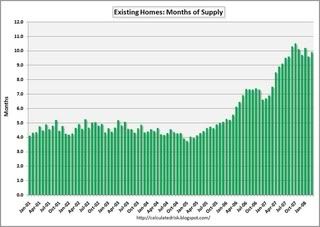

This translates into a little under a 10 months supply. Also note that this number -- months of supply -- has been increasing.

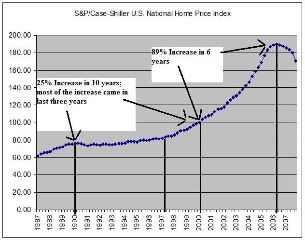

So -- we have a ton of supply on the market. Unfortunately that has not translated into a big enough cut in prices to stimulate demand. Here is a chart of the Case Shiller home price index.

Notice that prices increased about 90% in 6 years, yet have barely dropped in comparison to the massive run-up they had during the early 2000s. Simply put, we have a long way to go before we start seeing prices hit an inventory clearing level.

And who's going to buy these houses?

Job growth has been dropping, which is leading to

Dropping income, and

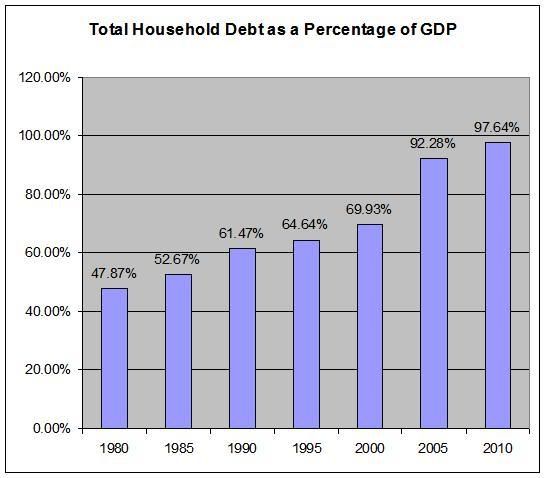

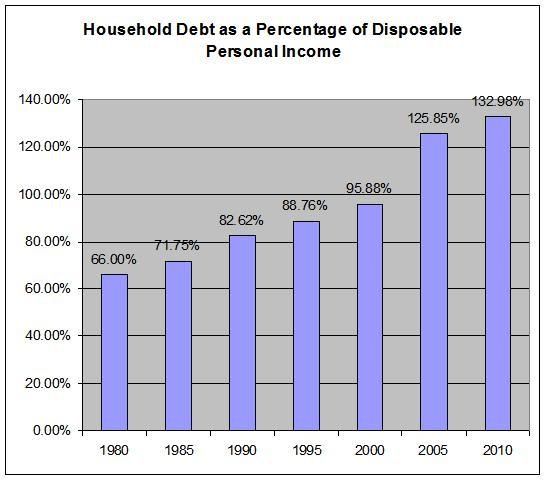

Dropping consumption. In addition, it's not like Americans can take on much more debt.

The basic economic facts are very straightforward: inventory is really high and demand is dropping. That means we can expect more price drops for the foreseeable future.

The point of all this there are big problems out there in econ land outside of the credit crisis.

But many analysts aren't convinced that the coast is truly clear after nine months of ever-deepening turmoil in the markets.

Even as they raise new capital, banks seem unlikely to open the flood gates to borrowers on new loans. "Banks are preserving their liquidity for their most important banking relationships," says Steven Victorin, Citigroup's head of global loans for Europe and North America. "The use of capital will be a cautious effort."

"I think this is a head-fake," says Strategas's Mr. Trennert. Even if the worst of the turmoil is past, he says, the economy's adjustment from the unwinding of the credit boom could linger for the next couple of years.