The dollar fell for a fifth day against the yen on speculation the Federal Reserve will lower interest rates by at least 1 percentage point today to revive confidence in financial markets.

The U.S. currency also weakened for a fifth day against the euro. Traders increased bets the Fed will slash its the target for the overnight lending rate between banks to 2 percent after the Fed made an emergency cut in its discount interest rate.

``Investors are fixated on the upcoming Fed rate decision,'' said Kosuke Hanao, head of foreign exchange in Tokyo at HSBC Bank, a unit of Europe's biggest lender. ``The Fed will cut rates by 1 percent.''

The U.S. currency fell to 96.94 yen at 9:45 a.m. in Tokyo from 97.33 late yesterday, when it touched 95.76 yen, the weakest since Aug. 15, 1995. The dollar traded at $1.5758 per euro, after reaching $1.5903 yesterday, the lowest level since the euro started trading in 1999. It traded at 0.9826 Swiss franc, approaching a record low of 0.9638 francs.

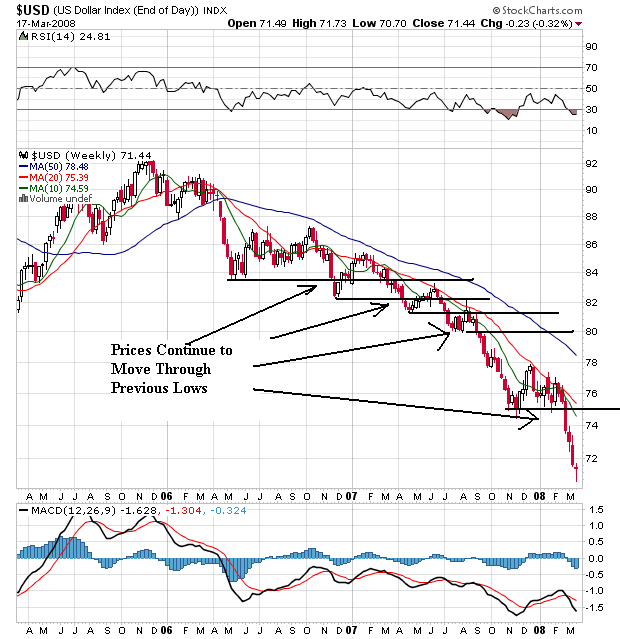

Let's take a look at the charts.

On the weekly chart, note for the last two years the dollar continually moved through price support levels. The dollar has lost about 20% of its value since the beginning of 2006.

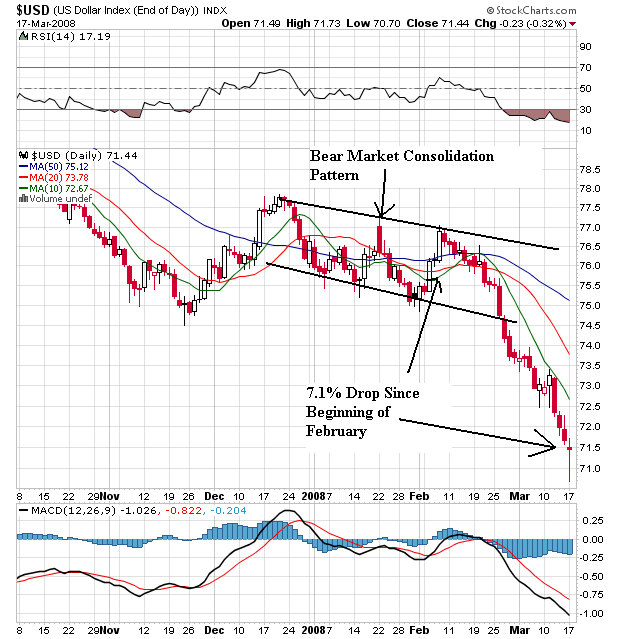

On the daily chart, notice the following:

-- Prices are below all the simple moving averages (SMAs). This will pull the SMAs lower

-- The shorter SMAs are below the longer SMAs

-- All the SMAs are moving lower.

In short, this is a very bearish chart.