But first, here are the main events that move the Treasury market:

Inflation expectations: Treasury investors get a fixed rate of return, so anything that lowers that fixed rate of return should cause the market to sell-off.

Flight to safety: The more uncertain the economic times, the more likely investors will buy Treasury bonds.

Interest rate policy: When the Federal Reserve is lowering interest rates, previously issued debt with higher coupons becomes inherently more valuable because it has a higher yield. When the Fed is raising rates, previously issued debt is less valuable because it inherently has a lower yield.

The importance of each of these factors varies depending on more factors than you can count.

The 7-10 year area of the market is still firmly in an uptrend marked by higher highs and higher lows, although it is currently forming a flag consolidation pattern.

Concern about the economy and the credit markets is leading investors to move into Treasuries. The Fed's interest rate policy is also helping. However, consider this information from the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.1 percent in December before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The December level of 210.036 (1982-84=100) was 4.1 percent higher than in December 2006.

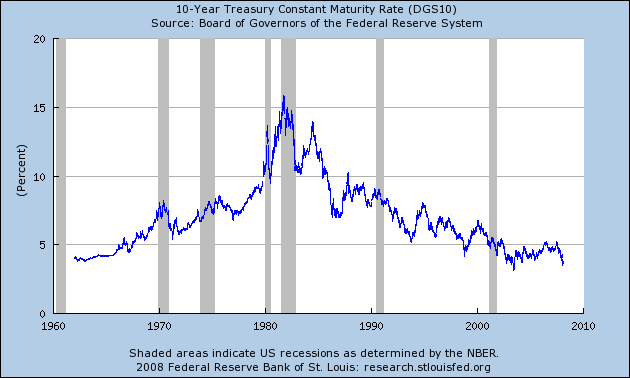

And now look at this chart from the St. Louis Federal Reserve of the yield of the 10-year CMT (constant maturing treasury):

The real return on the 10-year Treasury is negative after adjusting for inflation. That should tell you how concerned investors are about the markets and the economy.

The 20+ year area of the Treasury market is still rallying as well. It has a clear pattern of higher highs and higher lows. Right now prices are retreating to the trend line, so we'll see if this pattern holds.

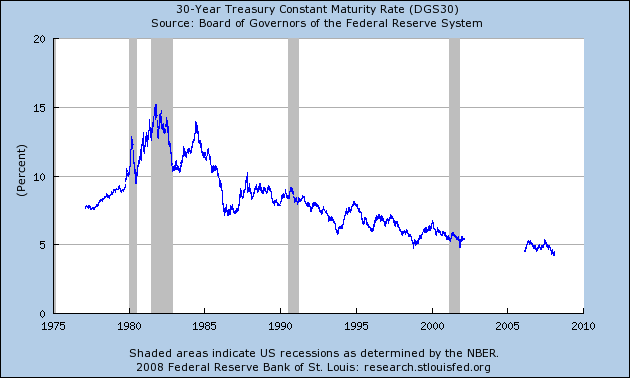

However, consider the inflation information from above plus the following chart of the 30-year CMT yield:

According to Bloomberg, the current yield on the 30 year is 4.48%, making it's inflation adjusted interest rates .38.

The Treasury market is not an area where investors play for capital gain. Income is always a consideration. That means safety of capital and return of capital (not return on capital) is driving a lot of traders and investors right now.