However, there are some other very important reasons why I think this is a bone-headed move.

Interest rates aren't that high right now.

To listen to the rate cutting crowd, you would think that interest rates were at godawful levels that prevented lending. Nothing could be further from the truth.

Above is a chart of the effective Fed funds rate. I eyeballed a line from current rates back through the history of previous rates. Notice today's rates aren't that high, especially in a historical context. In other words, money isn't that expensive right now.

Above is a chart of th constantly maturing 10-year Treasury. Note that rates have been declining for nearly 20 years.

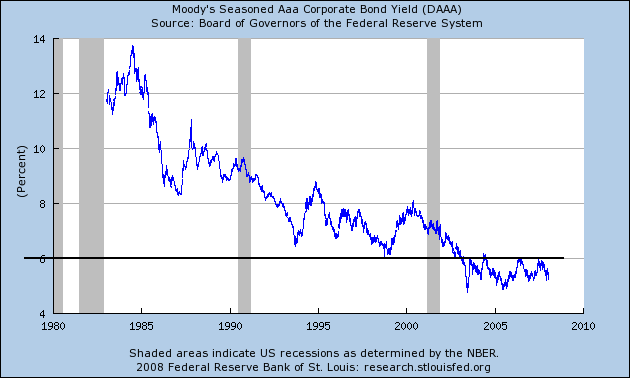

Above is a chart of AAA corporate paper. Notice the highest rates have been during this expansion corresponds to the low point of the previous cycle. Simply eyeballing the chart, it looks like AAA corporate paper is about 5.25%. That's not expensive at all.

The same analysis goes for BBB paper -- it's just not that expensive to borrow right now, even for a riskier corporate credit.

So -- interest rates just aren't that high right now.

Inflation is on the horizon

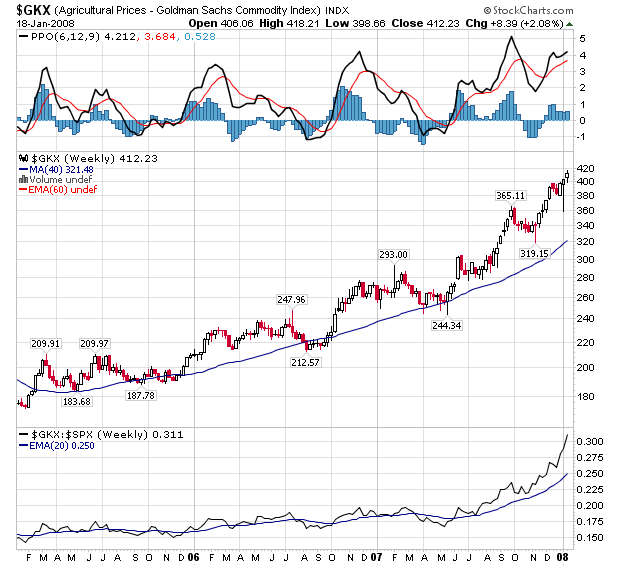

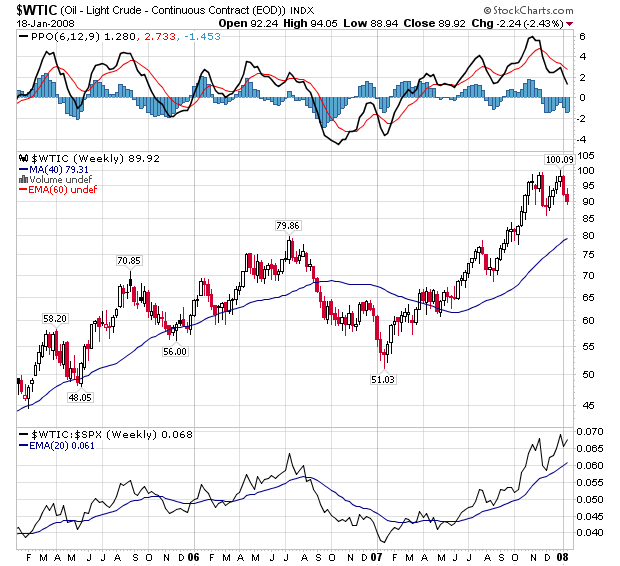

You've seen them before and you'll see them again. I should probably start asking regular readers to draw these graphs from memory. But --

Agricultural prices are in the middle of a three year bull run

And oil prices are in the middle of a year long bull run -- although they may be forming a double top here. But either way -- oil prices have increased smartly over the last year.

So -- we may have a really ugly inflation picture emerging.

So -- the Fed cuts rates in an environment when money isn't that expensive and inflation is rising. That's just not a good idea.