A measure of the liquid money supply within an economy. MZM represents all money in M2 less the time deposits, plus all money market funds.

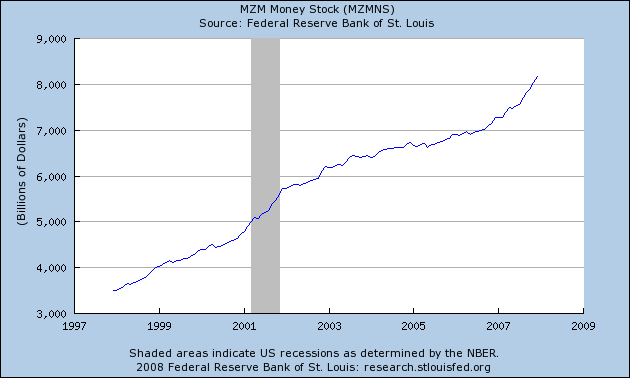

Here is a chart from the St. Louis Federal Reserve of the total MZM money supply:

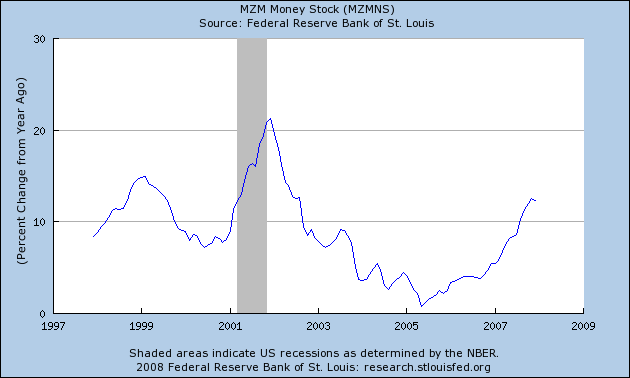

Notice that starting in late 2005 the total started increasing and has been increasing ever since. Let's see what the percentage change chart looks like:

This number has been increasing for the last year and a half, indicating money supply is increasing.

And then there is M3, which the government no longer publishes but which is available from the website shadowstats:

That's a huge increase.

So -- the issue isn't money supply. The facts show there is ample money in the system. The basic problem is no one wants to lend right now.