The Federal Reserve will probably cut its benchmark interest rate today for the first time in four years, seeking insurance against a recession. The main question is how big a policy Chairman Ben S. Bernanke is ready to buy.

While a quarter-point reduction in the federal funds rate may not be enough to bolster growth and investor confidence, a half-point cut might fan inflation and be perceived as giving in to pressure from Wall Street firms that made bad bets, especially in the market for securities backed by subprime mortgages.

Bernanke and fellow policy makers ``are really caught,'' said Robert Eisenbeis, a former research director at the Fed's bank in Atlanta who attended meetings of the rate-setting Federal Open Market Committee before retiring early this year. ``The Fed needs to avoid the perception of bailing out the markets, lenders or borrowers.''

I'm expecting a 25 BP cut today. I have no idea where the 50 BP idea came from. From what we have seen from Bernanke, we know he's a gradualist. At minimum, he'll only lower 25 BP because that leaves him with more ammunition for possible further cuts.

In addition, I wouldn't be surprised to see further action on the discount rate. While I at first was against this move because I thought Bernanke was paving the way for a Fed Funds cut, I now think cutting the discount rate was a good idea, largely because it is a rate specifically targeted at the financial community. That's where all of the problems are occurring right now.

Bernanke is in a really terrible position right now; I don't envy him in any way. On one hand he's got

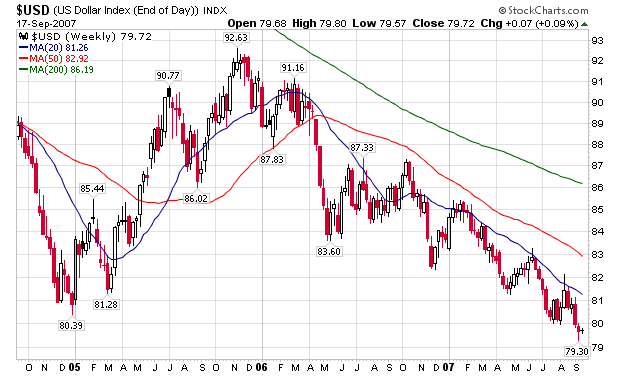

A very weak dollar

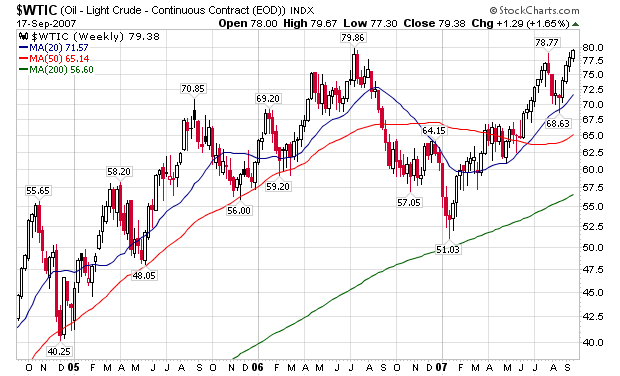

Spiking oil prices

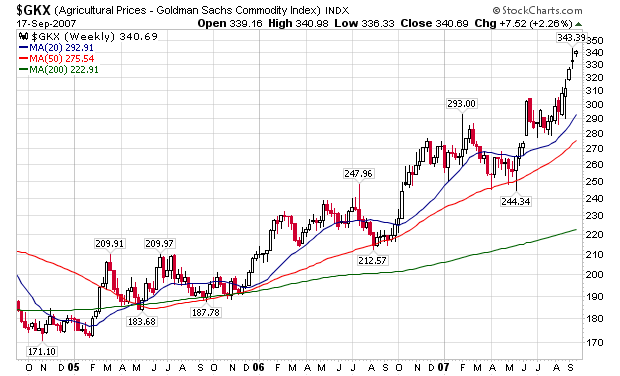

And rising agricultural prices.

On the other hand --

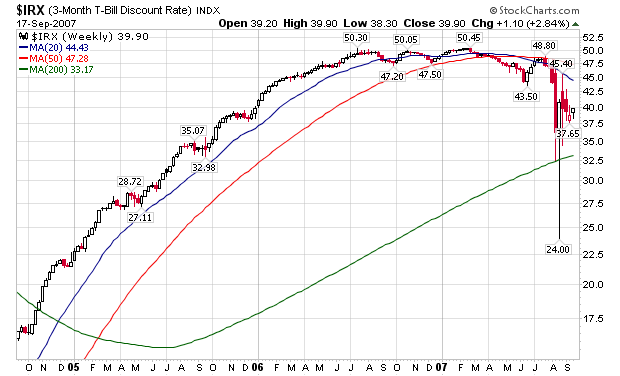

The short term credit markets are clearly not out of the woods, employment growth is weak and the housing market is in a mess that won't turn around for a long time.

No matter what Bernanke does, he's between a rock and a hard place. I certainly don't envy his job in any way right now.