Showing posts with label PPI. Show all posts

Showing posts with label PPI. Show all posts

Wednesday, September 18, 2013

The Non-Existent Inflationary Threat

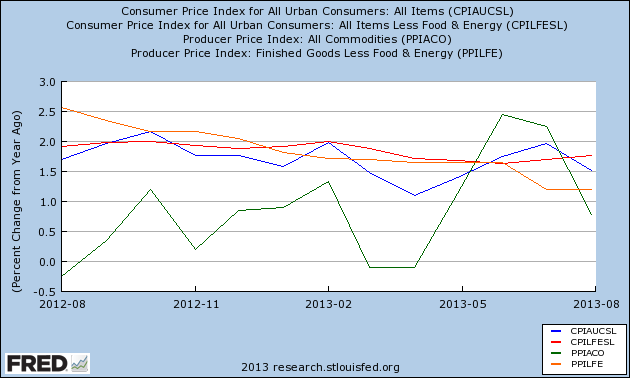

The above chart shows the year over year percentage change in CPI and PPI, both the total number and core. Notice that with the exception of PPI, the numbers have been very contained.

The above chart shows the same information except for the last year. Again, inflation is clearly contained.

Wednesday, March 7, 2012

1954: Prices and Fed Policy

Prices were incredibly subdued in 1954. Consider the following charts:

The year over year percentage change in PPI was mild for the first half of the year and negative for the second -- albeit very slightly negative.

The year over year percentage change in CPI showed the exact same pattern as PPI.

Also consider these price charts from the 1954 Federal Reserve policy review:

Remember that in early 1951, Congress passed a price control act as a way to prevent price spikes during a time of war. Also remember that there were wage and price panels that monitored and set prices for a bit of time after the passage of that act.

However, as prices were contained, interest rates dropped:

The year over year percentage change in PPI was mild for the first half of the year and negative for the second -- albeit very slightly negative.

The year over year percentage change in CPI showed the exact same pattern as PPI.

Also consider these price charts from the 1954 Federal Reserve policy review:

Remember that in early 1951, Congress passed a price control act as a way to prevent price spikes during a time of war. Also remember that there were wage and price panels that monitored and set prices for a bit of time after the passage of that act.

However, as prices were contained, interest rates dropped:

Wednesday, January 25, 2012

1952: Inflation and Fed Policy

This posting is part of the Bonddad Economic History Project

CPI was quite moderate. The YOY percentage change started at 4% and slowly decreased throughout the year to a little under 1%. Now, this type of deceleration can also be a sign of a potential recession on the horizon, which did start in the 3Q of 1953.

The YOY percentage change in PPI was negative for the entire year, indicating the input prices were dropping.

The above charts shows the absolute PPI level for the year, which shows the drop more completely.

As a result of the stable inflation picture, we see that the Fed did not raise rates in 1952. We also see that interest rates were fairly steady, with the exception of the continued upward movement of Treasury Bills, which jumped higher at the end of the year. The Fed explained the increased as an increased demand for loans at the end of the year.

The above table shows the increase in various types of loans over the year. Note the slow pace at the beginning of the year, while we see a big bump in the 4th quarter. We see two reasons for the increase. Business loans increased, with almost all of the increase coming in the fourth quarter. In addition, "other loans to individuals" increased by $2.2 billion , but this increase came from a strong growth in the second, third and fourth quarters (for more on the increase in consumer credit, see the 1952; PCE post).

The above tables shows that corporate security issues rose strongly in 1952, and competed for commercially available capital. The increase in 4th quarter lending was probably partially caused by an inability to complete an offering prior the end of the year. Again, note the large increase in consumer credit.

In short, what we see here is a fairly stable financial system.

CPI was quite moderate. The YOY percentage change started at 4% and slowly decreased throughout the year to a little under 1%. Now, this type of deceleration can also be a sign of a potential recession on the horizon, which did start in the 3Q of 1953.

The YOY percentage change in PPI was negative for the entire year, indicating the input prices were dropping.

The above charts shows the absolute PPI level for the year, which shows the drop more completely.

As a result of the stable inflation picture, we see that the Fed did not raise rates in 1952. We also see that interest rates were fairly steady, with the exception of the continued upward movement of Treasury Bills, which jumped higher at the end of the year. The Fed explained the increased as an increased demand for loans at the end of the year.

The above table shows the increase in various types of loans over the year. Note the slow pace at the beginning of the year, while we see a big bump in the 4th quarter. We see two reasons for the increase. Business loans increased, with almost all of the increase coming in the fourth quarter. In addition, "other loans to individuals" increased by $2.2 billion , but this increase came from a strong growth in the second, third and fourth quarters (for more on the increase in consumer credit, see the 1952; PCE post).

The above tables shows that corporate security issues rose strongly in 1952, and competed for commercially available capital. The increase in 4th quarter lending was probably partially caused by an inability to complete an offering prior the end of the year. Again, note the large increase in consumer credit.

In short, what we see here is a fairly stable financial system.

Tuesday, January 10, 2012

1951; Prices and Fed Policy

This is part of the Bonddad Economic History Project

Remember that the early 1950s saw tremendous growth in consumer demand and employment growth (see here and here). Hence there is s tremendous amount of demand pull inflation in the economy. In addition, the US is now producing for a massive war effort, which greatly increases the demand of basically every raw material. As such, inflation increases. Yet, in 1951 we see a decrease in inflation, which leads to the question, why?

Price controls. In 1951, Congress passed the General Ceiling Price Regulation of 1951, which froze prices at their highest level reached in late December 1950 and late January 1951.

Also of extreme importance this year was the Treasury Fed-Accord of 1951, which was:

In short, the Fed no longer had to buy bonds at set prices; as such lenders could no longer count on

the Fed to purchase bonds whenever they (the lenders) needed to extend credit. As such,

Business loans still grew at a strong rate, largely thanks to loans for essential war activity. The constraints on consumer lending show clearly on the chart (and below, which show a small .1% increase in consumer lending) as does the constraints on mortgage credit.

The above chart shows the overall upward drift of interest rates in the government security areas, which was primarily caused by the new arrangement between the Fed and the Treasury department.

Finally, consider the following charts of inflation from the 1952 Economic Report to the President.

Remember that the early 1950s saw tremendous growth in consumer demand and employment growth (see here and here). Hence there is s tremendous amount of demand pull inflation in the economy. In addition, the US is now producing for a massive war effort, which greatly increases the demand of basically every raw material. As such, inflation increases. Yet, in 1951 we see a decrease in inflation, which leads to the question, why?

Price controls. In 1951, Congress passed the General Ceiling Price Regulation of 1951, which froze prices at their highest level reached in late December 1950 and late January 1951.

Also of extreme importance this year was the Treasury Fed-Accord of 1951, which was:

Agreement between the U.S. Treasury Department and the Federal Reserve Board of Governors that enabled the Fed to pursue an active Monetary Policy, independent of the Treasury and the federal government. Before 1951, the Fed had to assure low cost Treasury financing by purchasing Treasury securities at a set price. Afterward, the Federal Reserve Open Market Committee was able to purchase as much, or as little, of Treasury securities offered for sale by the Treasury Department as it wanted, instead of having to buy whatever the Treasury issued at the prevailing rate. Also known as the Treasury-Fed Accord.You can read a more complete history at the Richmond Fed.

In short, the Fed no longer had to buy bonds at set prices; as such lenders could no longer count on

the Fed to purchase bonds whenever they (the lenders) needed to extend credit. As such,

While the Fed did not raise the discount rate, they did increase the reserve requirements for banks, and the margin account requirements for stock purchasers. They also tightened installment credit terms and real estate lending. In addition, there was also a voluntary restraint on "non-essential lending, related to war activity.

The charts below, from the Federal Reserve report, show the changes in overall credit for year.

Business loans still grew at a strong rate, largely thanks to loans for essential war activity. The constraints on consumer lending show clearly on the chart (and below, which show a small .1% increase in consumer lending) as does the constraints on mortgage credit.

Finally, consider the following charts of inflation from the 1952 Economic Report to the President.

Wednesday, June 17, 2009

Laughing at Laffer

Friday, May 15, 2009

Inflation Overview

Click on all images for a larger image

From the BLS:

The Producer Price Index for Finished Goods increased 0.3 percent in April, seasonally adjusted, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. This rise followed a 1.2-percent decline in March and a 0.1-percent increase in February. At the earlier stages of processing, prices received by producers of intermediate goods moved down 0.5 percent following a 1.5-percent decrease a month earlier, and the crude goods index advanced 3.0 percent after declining 0.3 percent in March.

Here is the relevant chart:

Click for a larger image.

On a year over year basis, prices have been dropping hard. In addition, observe on this chart from the report:

The 12-month price changes in crude and intermediate goods are accelerating. But

The month to month change in crude goods is moderating, as is the month to month change in intermediate goods (if you look back to October of last year). In addition,

The 12 month percentage change in producer prices is still positive, indicating most of what we're seeing is the massive drop in commodities:

Also note it appears commodity prices have hit bottom and are currently inching higher right now.

From the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in April before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. This index has fallen 0.7 percent over the last 12 months, due primarily to a 25.2 percent drop in energy prices. The year-over-year declines in March and April are the first since 1955.

Here's the chart from the release:

Core increased 1.9% indicating that food and energy costs aren't impacting overall inflation. These charts from the St. Louis Fed demonstrate this:

The total CPI measure has dropped and

The year over year rate is now negative. But

The core rate is moving higher and the core's year over year rate is

Also moving higher and has never been negative although -- like PPI -- it had a major drop at th end of last year.

Wednesday, April 15, 2009

A Closer Look at Inflation

We've had both PPI and CPI come out over the last two days. Let's take a look at the reports to see what they say:

Form the BLS:

Here's the year over year chart from Econoday:

Prices have been hanging right around the 0% YOY for the last 4 months. This is a dangerous place because it could signal price deflation which would be terrible. The good news in the report is the energy prices and to a lesser degree food prices appear to be the main culprit of deflation:

And there is this as well:

Looking at the chart above, note the gray lines the show the year over year percent change in the core rate. That series of data points stands just shy of two percent which is also encouraging from an anti-deflation standpoint. That does not mean we are out of the woods yet, however.

But then there is this information about producer prices:

Accompanied by this chart:

Remember, producer prices feed into consumer prices. This means they happen first. So the drop above could start to hit CPI eventually.

PPI prices are broken down into three categories: crude goods, intermediate goods and finished goods. Here are the charts of the year over year percentage change in all three.

All three show incredibly large year over year drops. While at some time in the past we have been at these levels, its not very often. As a result, we need to keep an incredibly close eye on these data points.

Form the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in March, before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The index has decreased 0.4 percent over the last year, the first 12 month decline since August 1955.

On a seasonally adjusted basis, the CPI-U decreased 0.1 percent in March after rising 0.4 percent in February. The decrease was due to a downturn in the energy index, which declined 3.0 percent in March after rising 3.3 percent the previous month. All the energy indexes decreased, particularly the indexes for fuel oil, natural gas, and motor fuel. The food index declined 0.1 percent for the second straight month to virtually the same level as October 2008. The food at home index declined 0.4 percent, the second straight such decrease, as the index for dairy and related products continued to decline.

Here's the year over year chart from Econoday:

Prices have been hanging right around the 0% YOY for the last 4 months. This is a dangerous place because it could signal price deflation which would be terrible. The good news in the report is the energy prices and to a lesser degree food prices appear to be the main culprit of deflation:

All the energy indexes decreased, particularly the indexes for fuel oil, natural gas, and motor fuel. The food index declined 0.1 percent for the second straight month to virtually the same level as October 2008. The food at home index declined 0.4 percent, the second straight such decrease, as the index for dairy and related products continued to decline.

And there is this as well:

The index for all items less food and energy increased 0.2 percent for the third month in a row.

Looking at the chart above, note the gray lines the show the year over year percent change in the core rate. That series of data points stands just shy of two percent which is also encouraging from an anti-deflation standpoint. That does not mean we are out of the woods yet, however.

But then there is this information about producer prices:

The Producer Price Index for Finished Goods decreased 1.2 percent in March, seasonally adjusted. This decline followed a 0.1-percent advance in February and a 0.8-percent increase in January.

Accompanied by this chart:

Remember, producer prices feed into consumer prices. This means they happen first. So the drop above could start to hit CPI eventually.

PPI prices are broken down into three categories: crude goods, intermediate goods and finished goods. Here are the charts of the year over year percentage change in all three.

All three show incredibly large year over year drops. While at some time in the past we have been at these levels, its not very often. As a result, we need to keep an incredibly close eye on these data points.

Friday, March 20, 2009

A Closer Look At Inflation

Click on all pictures for a larger image.

From the BLS:

There has been a some virtual ink spilled over the question of deflation -- that is, are we going into a period of deflation somewhat like that of the Great Depression. So far the evidence is a bit mixed. First, The change from the preceding month in core PPI has only been negative once in the last 12 months. This was November's -.1 decline. This tells me that so far the decline has to do with the commodity deflation over the last 9 months as this chart shows:

However, we have seen one of the biggest drops in overall PPI in an incredibly long series of data:

In addition, the year over year number is still scary:

But also note in the above chart that prices have dropped at this level before -- in 2001 -- without the fear of deflation emerging.

In addition, so far the rate of decline in both intermediate and crude goods as decreased over the last two months. Intermediate goods decreased at a roughly 4%/month clip in the October, November and December of last year, but fell at a .7% and .9% clip in January and February of this year. Crude goods show a similar pattern: they fell at (approximately) 16%, 14% and 5% in October, November and December of last year but at a 3% and 4.5% clip in January and February of this year.

In other words, from the PPI perspective, I'm leaning towards the "there isn't a deflation problem" conclusion.

From the BLS:

Like the PPI data, the CPI data shows drop in 4Q of 2004 and increases so far this year. For October, November and December of last year there were drops in overall CPI of -.8%, -1.7%, -.8%, respectively, but in January and February of this year we saw increases of .3%, .4% respectively. More importantly, this appears to be a commodity related situation. The month over month rate of increase in core CPI for October - February was .0%, .1% , .0%, .2%, .2% respectively.

That does not mean there shouldn't be cause for concern. Consider this chart of CPI data

That's one of the largest drops in CPI the data has seen over the last half century. In addition,

The year over year chart of CPI is ugly, and its far too early to tell if we're at the beginning of an upswing or not.

In general, it looks to me as though the price drops of the last 5 months are related and confined to the energy/commodity drops of the last 9 months. That does not mean we shouldn't keep an eye on these numbers. But the latest upticks in overall data and the lack of spreading to core numbers gives me the impression the "deflationary spiral" argument is losing steam.

From the BLS:

The Producer Price Index for Finished Goods advanced 0.1 percent in February, seasonally adjusted, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. This rise followed a 0.8-percent increase in January and a 1.9-percent decline in December. At the earlier stages of processing, prices received by manufacturers of intermediate goods decreased 0.9 percent in February after falling 0.7 percent in the previous month, and the index for crude materials declined 4.5 percent following a 2.9-percent decrease in January. (See table A.)

There has been a some virtual ink spilled over the question of deflation -- that is, are we going into a period of deflation somewhat like that of the Great Depression. So far the evidence is a bit mixed. First, The change from the preceding month in core PPI has only been negative once in the last 12 months. This was November's -.1 decline. This tells me that so far the decline has to do with the commodity deflation over the last 9 months as this chart shows:

However, we have seen one of the biggest drops in overall PPI in an incredibly long series of data:

In addition, the year over year number is still scary:

But also note in the above chart that prices have dropped at this level before -- in 2001 -- without the fear of deflation emerging.

In addition, so far the rate of decline in both intermediate and crude goods as decreased over the last two months. Intermediate goods decreased at a roughly 4%/month clip in the October, November and December of last year, but fell at a .7% and .9% clip in January and February of this year. Crude goods show a similar pattern: they fell at (approximately) 16%, 14% and 5% in October, November and December of last year but at a 3% and 4.5% clip in January and February of this year.

In other words, from the PPI perspective, I'm leaning towards the "there isn't a deflation problem" conclusion.

From the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in February, before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The February level of 212.193 (1982-84=100) was 0.2 percent higher than in February 2008

Like the PPI data, the CPI data shows drop in 4Q of 2004 and increases so far this year. For October, November and December of last year there were drops in overall CPI of -.8%, -1.7%, -.8%, respectively, but in January and February of this year we saw increases of .3%, .4% respectively. More importantly, this appears to be a commodity related situation. The month over month rate of increase in core CPI for October - February was .0%, .1% , .0%, .2%, .2% respectively.

That does not mean there shouldn't be cause for concern. Consider this chart of CPI data

That's one of the largest drops in CPI the data has seen over the last half century. In addition,

The year over year chart of CPI is ugly, and its far too early to tell if we're at the beginning of an upswing or not.

In general, it looks to me as though the price drops of the last 5 months are related and confined to the energy/commodity drops of the last 9 months. That does not mean we shouldn't keep an eye on these numbers. But the latest upticks in overall data and the lack of spreading to core numbers gives me the impression the "deflationary spiral" argument is losing steam.

Friday, February 20, 2009

Import, Producer and Consumer Price Round-Up

From the BLS:

Looking at the BLS' end use tables we see drops in industrial supplies and goods but increases in capital goods, autos and consumer goods. However, all imports excluding fuels and all imports excluding petroleum have been decreasing for the last four months.

Non-manufactured articles dropped 45.9% year over year.

Manufactured articles dropped 3.7% year over year.

Here's the chart from Econoday:

From the BLS:

What makes this news less scary is that core PPI has been increasing for the last five months when we've been seeing large decreases in the overall PPI. However, core prices of intermediate goods have been decreasing for the last four months and core prices of crude goods decreased throughout the fourth quarter of 2008 while ticking up slightly last month. In other words, there could be downward pressure on prices over the next few months.

Here are the relevant charts from Econoday:

From the BLS:

The good news here is core prices are still positive for the last 8 months. This tells us that price drops are occurring in the food/energy area rather than overall. A big reason for the drop in CPI over the last half of 2008 was transportation costs. Here is a chart of gas prices from that period:

In addition, although agricultural prices have dropped over the same period:

They have remained positive in the CPI numbers over the last half of 2008.

Import prices fell 1.1 percent in January and 23.4 percent over the past six months. For the sixth consecutive month, petroleum prices and nonpetroleum prices decreased, falling 2.4 percent and 0.8 percent, respectively, in January. However, prices for both overall imports and petroleum decreased at a smaller rate in January than in each of the previous five months since prices last rose in July. Petroleum prices fell 69.1 percent over the past six months and 55.0 percent over the past year, the largest 12-month decline since the index was first published in June 1982. Overall, import prices fell 12.5 percent for the year ended in January, the largest 12-month decline since the index was first published in September 1982. Nonpetroleum prices decreased 5.7 percent over the past six months and 0.6 percent over the past year.

The 0.8 percent January decrease in nonpetroleum prices was led by a 4.8 percent drop in the price index for nonpetroleum industrial supplies and materials. Falling prices for chemicals and natural gas were the largest contributors to the decline. Nonpetroleum industrial supplies and materials prices decreased 7.6 percent over the past year, led primarily by declining unfinished metals prices.

In contrast, prices for automotive vehicles increased in January, rising 0.2 percent after decreasing the previous two months. For the year ended in January, the index increased 0.7 percent.

The price indexes for consumer goods, capital goods, and foods, feeds, and beverages were unchanged in January. Over the past year, consumer goods prices increased 1.5 percent, capital goods prices advanced 0.9 percent, and prices for foods, feeds, and beverages rose 3.3 percent.

Looking at the BLS' end use tables we see drops in industrial supplies and goods but increases in capital goods, autos and consumer goods. However, all imports excluding fuels and all imports excluding petroleum have been decreasing for the last four months.

Non-manufactured articles dropped 45.9% year over year.

Manufactured articles dropped 3.7% year over year.

Here's the chart from Econoday:

From the BLS:

The Producer Price Index for Finished Goods rose 0.8 percent in January, seasonally adjusted, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. This increase followed declines of 1.9 percent in December and 2.5 percent in November. At the earlier stages of processing, the decrease in prices for intermediate materials slowed to 0.7 percent from 4.2 percent in the prior month, and the index for crude materials declined 2.9 percent after dropping 5.3 percent in December.

What makes this news less scary is that core PPI has been increasing for the last five months when we've been seeing large decreases in the overall PPI. However, core prices of intermediate goods have been decreasing for the last four months and core prices of crude goods decreased throughout the fourth quarter of 2008 while ticking up slightly last month. In other words, there could be downward pressure on prices over the next few months.

Here are the relevant charts from Econoday:

From the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in January, before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The January level of 211.143 (1982-84=100) was virtually unchanged from January 2008.

The good news here is core prices are still positive for the last 8 months. This tells us that price drops are occurring in the food/energy area rather than overall. A big reason for the drop in CPI over the last half of 2008 was transportation costs. Here is a chart of gas prices from that period:

In addition, although agricultural prices have dropped over the same period:

They have remained positive in the CPI numbers over the last half of 2008.

Subscribe to:

Posts (Atom)