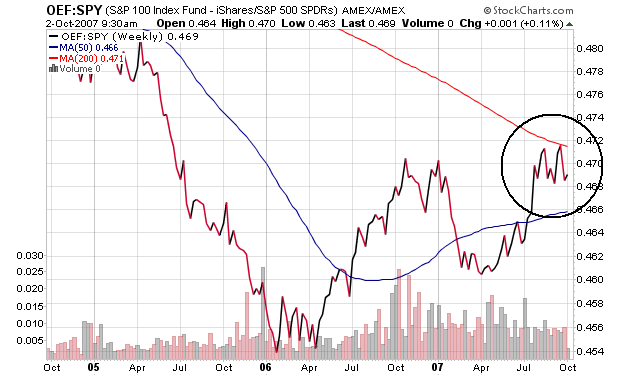

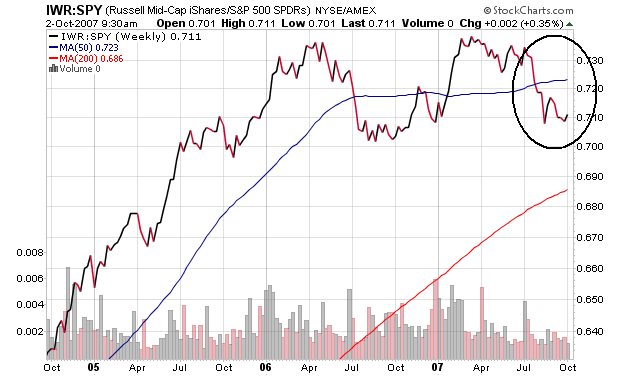

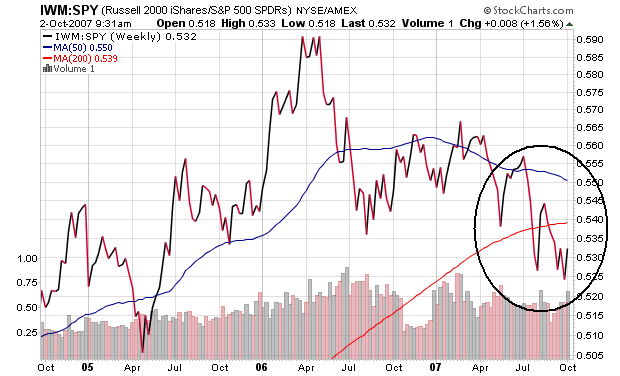

By far the biggest winner in the post-July credit market problem environment is the S&P 100 or the big cap stocks. Traders are betting that larger companies will outperform the market. This tells me a few things.

1.) Traders are looking for some safety right now. That means there is still concern about the underlying fundamentals. The soft-landing scenario is a good game to talk about, but the action of the dollars is the more telling statement.

2.) My guess is traders are thinking that these companies have more foreign exposure. This means the falling dollar is playing into trader's strategy right now.