Mr. Bence is one of the people benefiting from one of the few bright spots in a slowing U.S. economy. While a weaker dollar hurts consumers by raising the price of imported goods, it also is helping the economy stave off a deeper slowdown, by making U.S. exports more competitive and influencing more foreigners to visit Disney World or the Statue of Liberty.

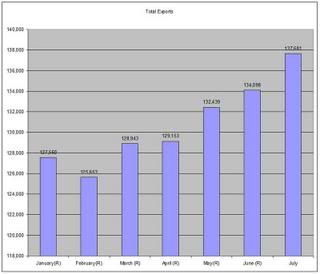

First, here is a graph of exports for this year. Notice they are clearly in an uptrend.

Also note the size of exports could be enough to sway the country away from a recession. At the end of 2006, total US GDP was $13.392 trillion and total exports were $1.446 trillion, or 10.79% of GDP.

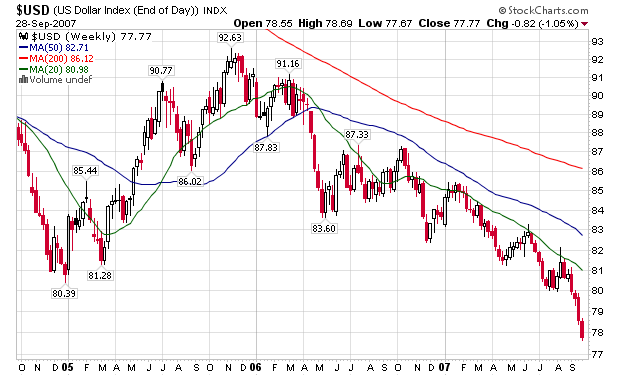

If the dollar falls too far and too fast, it could spur a run-up in interest rates and shake the stock market -- which would be bad for the economy. A rapidly falling dollar would raise the price of imports, stoking inflation, and in an extreme case could prompt foreign investors to dump U.S. bonds, pushing their yields higher.

...

But as long as the dollar's decline is gradual, most economists see it as a modest plus overall. Joshua Feinman, chief economist at Deutsche Asset Management, wrote in a recent note to investors that the export upswing is one of the factors "poised to help cushion the impact of the housing correction." Real exports have grown faster than real imports for nearly two years, notes Mr. Feinman, and he expects this trend to continue. U.S. exports rose 2.7% to a record $137.68 billion in July, according to the Commerce Department. Mr. Feinman estimates stronger exports have contributed a half percentage point of added growth to gross domestic product since 2005.

Notice the dollar chart indicates the dollar is falling gradually and has been for the better part of the last year and a half. That is good news for the economy because the devaluation is controlled. The problem with the current situation is the dollar is vulnerable to a random economic shock or event that could send it tumbling lower which would have very negative implications for the economy.

In addition, most of the world's commodities are priced in dollars. This means a falling dollar implies an upward bias in commodity prices which fuels inflation.